“ In my book, the Education of a Value Investor, I write about my difficulties in getting to a zero management fee structure for my fund. Indeed, it was only my meeting with Mohnish Pabrai, and our subsequent lunch with Warren Buffett that properly set me on that path.

Some years subsequent to that, I wanted to learn more about who else was doing something operating in such a structure. So I put a simple form up on my website and then handed the data to my director, Mark Chapman, who wrote it up in a the paper that follows.

It has become one of our most popular white papers — and has been accessed or downloaded more than 3,000 times.

—Guy Spier

Introduction and health warning

My goal in researching and writing this note was to shed some more light on a relatively obscure and little studied corner of the world of alternative investments –whereby a professional money manager does not charge an asset management fee.

To get a better sense of this universe, I used two sources:

Firstly, and with the help of Aaron Westlund of Poor Creek Capital, I reviewed forms ADV part 1 which are filed by United States based investment advisors who are regulated by the SEC as well as by state-regulated investment advisors.

Because of the paucity of data from those forms I also canvassed hedge funds around the world through email, social media and personal contacts to find out more in an ad-hoc way.

I did this work informally and alongside my work as a director of the Aquamarine Fund. In reaching my conclusions I have taken at face value and on trust statements that have not necessarily been properly verified.

Thus, none of the data and conclusions presented here should be considered conclusive or authoritative. Rather, they should be considered a jumping off point for further conversation and discussion. In that spirit, please do provide me with feedback and updated, or more accurate information, so that I can incorporate it into this write-up and redistribute to you.

The rest of this paper is divided into the following sections:

1. Short History of Hedge Funds and fee structures

2. Data & Findings

3. Conclusions and Thoughts

4. Survey Responses

5. Transcript of the Zero Management Fee Symposium

1. Short History Of Hedge Funds and Fee Structures

Hedge funds and their associated fee structures originated in the early fifties when an Australian-American, Alfred Winslow Jones, started what is considered to be the first hedge fund. There were two key innovative features to his fund:

- First, he combined two apparently risky strategies – shorting and leverage, with the goal of delivering better returns and lower volatility.

- Second, and unlike mutual funds, he did not charge a management fee. His fee structure was simply to take 20% of the profits each year.

Later that decade, Warren Buffett started his partnership, and he also did not charge a management fee. Moreover, instead of asking for 20% of the profits, he added a hurdle of 6% and a 25% performance fee.

Subsequent to that, others also started funds, although few stuck to Buffett’s and Winslow’s zero management fee formula. Many funds standardized on a “One and Twenty” model. But some went to “Two and Twenty”. And in his heyday, Steve Cohen’s SAC Capital is reputed to have gone as high as “Five and Fifty”.

But the world seems to have shifted. Hedge fund returns have moderated and we have witnessed a boom in indexing, index funds and ETFs. In this environment, while Two and Twenty still seems to be the most popular approach, there appears to be a trend to dial back down the fees that hedge fund managers charge their clients.

This takes place through various mechanisms. In addition to simply reducing the percentage charged, the following are also used:

- Introduce a “high water mark” mechanism ensures that the manager has recouped all prior losses for an investor before the manager earns a performance fee with respect to that investor.

- Introduce a “hurdle rate”, which requires the fund to achieve a stated return before the manager can earn a performance fee.

The benefits of lower fees are oftentimes offset by a “lock-up period” which specifies when an investor can or cannot make a withdrawal from the fund’, as well as by formal or ad hoc clawback or refund mechanisms.

So today, there exists at one end of the hedge fund fee spectrum a Two and Twenty like structure, where the manager’s approach is often: “If you don’t like it, go and invest somewhere else, as I need to be rewarded for my work even if I don’t make you any money”. But gaining popularity right at the other end of the spectrum is what we can call the zero management fee structure, where the manager only gets rewarded through a performance fee if he makes money, over a hurdle rate, for his investors.

2. Data and Findings

In the universe of investment advisers registered with the SEC with Assets Under Management of over $100,000,000 there are just three advisers that manage private hedge funds and who only charge a performance fee (i.e. zero management fee) across all entities they advise. These are Quantitative Investment Management, Biglari Capital and Piper Jaffray Investment Management. The underlying private hedge funds of these 3 advisers are Quantitative Tactical Aggressive Funds, The Lion Funds and Piper Jaffray Municipal Opportunities Fund.

For state-registered investment advisers with Assets Under Management less than $100,000,000, there are only eleven advisers that manage active private hedge funds and who only charge a performance fee (i.e. zero management fee) across all entities they advise. These funds are: Lockbox I, Steele Partners, Klute Capital Fund, Prelude Opportunity Fund, Lucky Man Partners, Weidmann Capital Partners, Asset Appreciation Fund of America, Wellford Partners, Bridge Reid Fund, Krohne Fund, Borman Creek Capital and SG3 Capital.

This is a miniscule fraction – considering the tens of thousands of Registered Investment Advisers in the US. But there is one wrinkle that suggests that the number might be higher: While many advisors do charge a performance-only fee to some of their funds, clients or classes they also manage other funds, clients or classes where a performance and management fee is charged and it’s just not possible, with the available data, to isolate and separate out data which will show advisors who charge a blend – performance-only to some funds/clients/classes versus performance and management fee for others.

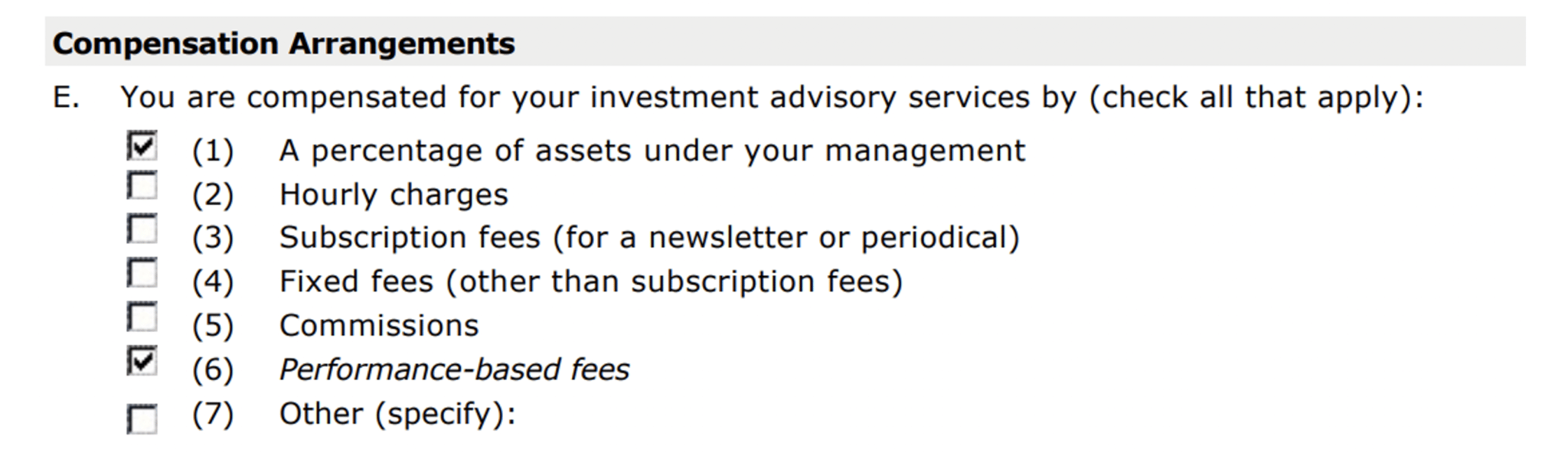

Take the Pabrai Funds for example. It is well documented that Mohnish Pabrai has not charged his Pabrai Investment Funds investors a management fee for very many years. However, on his Form ADV, the box “compensated by a percentage of assets” is ticked. This is surely the case for many other advisors, who in reality only charge performance fees.

Aaron Westlund adds colour to this: “Some of our initial non-accredited investors didn’t qualify to be charged an actual performance fee. So, for those initial non-accredited investors (we no longer have any non-accredited investors), we put in a management fee but committed that we would waive that fee down to what would have been charged as a performance fee instead”.

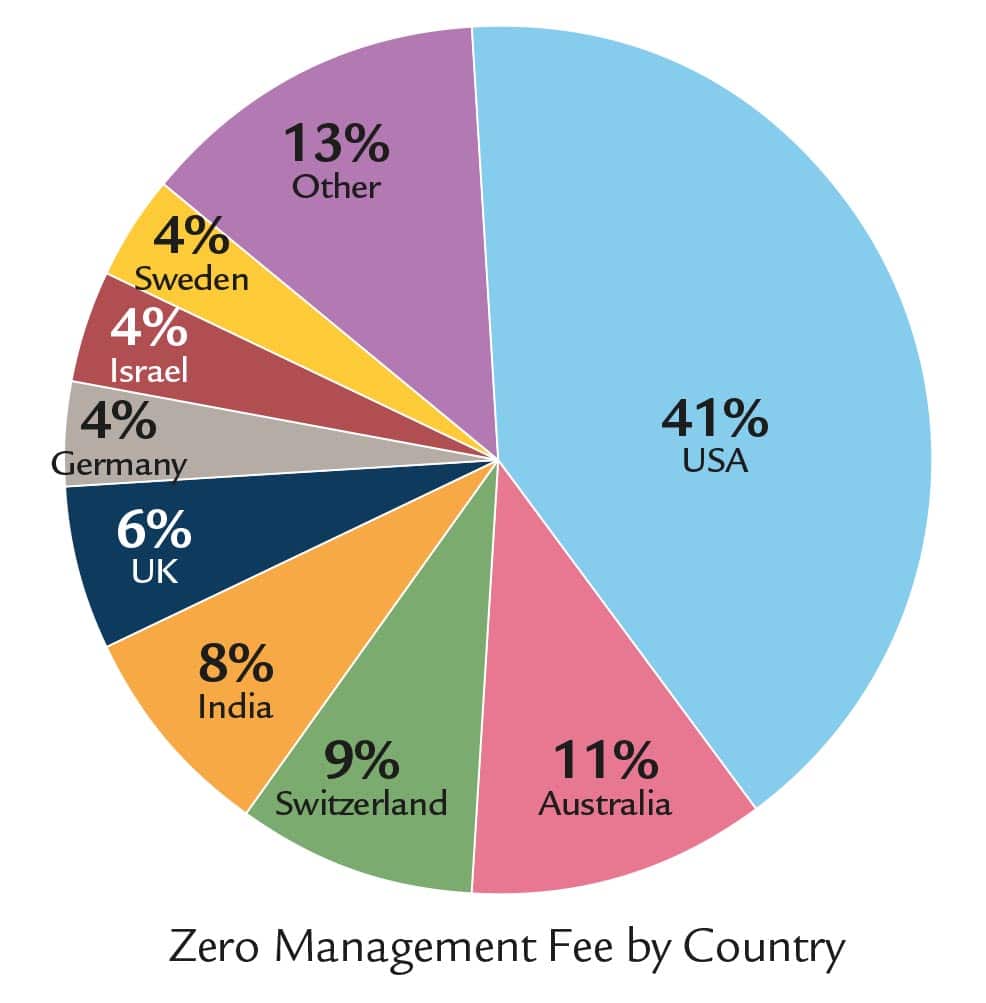

Notwithstanding what appears to be a small number of advisers that charge only a performance fee across all their funds, I was inundated with commentary from advisors and their friends across the globe about individual funds charging performance fees only (i.e. zero management fee funds or classes within a fund). The chart below shows where our responses came from and not surprisingly the USA was top of the list with 41%.

Some features from the commentary that was received from zero management fee managers follow:

The lock-up period for investors was generally one year but in some cases, there was no lock up and in one case a three year lock up. In general, I found that for funds offering zero management fees, the percentage of the fund beneficially owned by the manager and related persons was higher than I would normally expect to see in a private fund. I thank Rhys Summerton, from Milkwood Capital Limited who flagged this up for me when he wrote “I suspect what you will find is that the higher percentage of own capital of a fund, the more the fund manager will accept zero management fees and focus on performance fees”. Almost 100% of the respondents issued their NAV’s monthly and the predominant fund strategy was long only in a global geography. The most telling feature however was the significant number of managers who claimed to be value investors.

Whilst acknowledging that our sample size was small and there could be an element of bias on account of the fact that I am the director of a value fund, it is an interesting question whether managers who focus on value investing also believe they should only be rewarded if they perform significantly better that the market. The most popular performance fee structure in the zero management fee environment was a twenty-five percent (25%) annual incentive allocation in excess of a six percent (6%) non-cumulative hurdle return calculated annually, compared to the typical a twenty percent (20%) annual incentive allocation in the Two and Twenty scenario. However, this did vary up to thirty percent (30%) annual incentive allocation in excess of an eight percent (8%) hurdle.

I also found that new investors, when given the choice, were more likely to pick a zero management fee class rather than a Two and Twenty class, signifying a general investor recognition than managers should be compensated for performance.

However, for tax reasons I found that existing investors in a fund offering both options in different classes, were often loathe to shift to the zero management fee class as they would likely crystallise a taxable gain on the change in class.

In addition, I found several innovative fee structures, for example one run by Orbis Investments, called the Refundable Reserve Fee share class, where the performance fee is based on the relative performance experienced by each client and such performance fees are refunded in the event of subsequent underperformance. I thank Dan Brocklebank of Orbis Investments for sharing their complex but very fair fee arrangements with me.

3. Conclusions and Thoughts.

Upon further thought, the apparent rise in managers’ willingness to reduce their fees is rather remarkable – given the hurdles – or barriers standing in the way of a manager who does not want to charge his clients an asset management fee.

The first is that unless the manager has some other source of income, or is independently wealthy, implementing a zero management fee structure is a real stretch for most managers. Many of them desperately want to do it but the reality is that covering start-up expenses and the risk of a general market downturn in the first years of operation make in likely that few will venture this path. For while every manager will do their level best to outperform from year one, periods of underperformance are a fact of life and in a zero management fee environment, the manager may have to sustain years of operating losses before breaking even on the enterprise.

Thus, only the very luckiest or very best managers will be able to finance their first period of operations with no management fee unless they have the private, personal or family financial wherewithal to survive the start-up period.

For example, David Shapiro of Willis Towers Watson shared with me the story of Bedlam Asset Management, a UK based manager, launched in 2002 ridiculing ‘grossly overpaid’ fund managers and using the slogan: ‘No gain, no fee’. Bedlam was never really able to achieve the gains needed to make enough money for its performance-fee model to thrive but they did run for ten years before closing quietly in 2013, having got their AUM to over $500 million.

So, while new managers are not necessarily opting for Two and Twenty, they usually charge some sort of management fee to get their operation started, even if it is expense-based rather that asset-based.

Thus, existing managers often offer a blend of management and performance fees to exiting investors and performance only fees to new investors. The Aquamarine Fund, where I am a director has such a structure. In our case, the manager can afford to not get paid any performance fee for a significant period, relying on the pre-existing management fee for his survival. For example, from 2014 to the start of 2017, performance fee only investors paid Guy Spier nothing for his expertise and his efforts. While those periods may not be comfortable, they are doable.

And if this does not present a fraught enough picture for the aspiring zero management fee manager, he can have no doubt that the fund’s attorneys and other advisors will strongly counsel him against this course of action – at least in part because they are mindful of the need to pay one’s bills – especially theirs.

But in spite of these significant hurdles, I have no doubt that a multitude of zero management fee structures are currently being established.

Why is that?

Part of the reason is the competition that comes from indexing. Even Warren Buffett – who used to run a zero management fee fund now advocates for low-cost index funds. With so much money flowing into that part of the market and with many traditional hedge funds underperforming, managers feel the pressure to be able to demonstrably deliver value and driving their fees down is a way to do that.

Also, part of the explanation is that investors are becoming increasingly sophisticated, and understand quite clearly that in the case of indexing, by being forced to buy into the most over-valued members of the index, they may actually be setting themselves up for inferior results.

But rather than opt for a flat-fee manager, sophisticated investors realize that the only managers who would be willing to go to all the trouble and expense of setting up a fund in which they only get paid if they outperform a hurdle are the ones who are capable of outperforming. If one believes that, then simply choosing to invest in funds with zero management fees may be the best way to identify and invest with superior managers.

Even if only some investors think this way, that may be enough reason to entice better managers (or at least those with a high opinion of themselves) to step up and go the extra mile with a frugal fee structure.

Thus, offering a zero management fee structure may serve as a kind of signal for prospective investors.

If this is indeed the case, there is a lot more for fund managers to do in order to signal that they can beat the market. In most cases the annual hurdle rate is 6%, which makes a lot of sense. Most investors should be contented with a 6% annual return. But in the case of most funds with a 6% hurdle, it also has the feature that it is non-cumulative. That means if you are down 6% one year, the next year your hurdle isn’t 18% but it reverts to 6%.

A manager that truly wanted to signal his confidence in delivering superior annualized returns would be able to demonstrate that – by making their hurdle a cumulative one. So far, very few have done that.

4. Survey Responses

1 Mikael Tarnawski-Berlin runs Pandium Global pandiumcapital.com in Stockholm, Sweden. He charges 0% management fee and 25% performance fee on outperformance over MSCI World Net Total Return, with a three-year lock-up.

EGP Fund, https://egpcapital.com.au/ is managed by Tony Hansen from Sydney, Australia and charges 0% management fee and keeps 20% of returns earned in excess of this benchmark when it is positive: http://au.spindices.com/indices/equity/sp-asx-200-franking-credit-adjusted-annual-total-return-index-tax-exempt. Over 90% of his and his wife’s net worth are in their fund.

He adds that the zero-management fee movement is taking hold in Australia with a number of operators profiled here: https://bit.ly/2lLfZV1

2 Peter Phan is also from Sydney, Australia and runs Castlereagh Equity. He maintains a 6 % high watermark, and charges 25% of returns above the high watermark, the same as the initial Buffett Partnership castlereaghequity.com.au.

3 Another Australian Kane Doyle wrote to us: Be sure to check out affluencefunds.com.au – we are an Australian Fund Manager that currently have the Affluence Investment Fund open to all Australian and New Zealand resident investors. They charge a performance fee only, no management fee. This performance fee is on positive performance only! Our CEO/Portfolio Manager is Daryl Wilson.

4 Rhys Summerton runs $80m at The Milkwood Fund http://milkwoodcap.com/ based in Windsor, United Kingdom, whose Class A is zero management fee. Andre Tonkin adds: We are mostly on 0/10% with some money at 0.75%/10%. We may eventually convert the whole fund to an expenses-based management fee (once the scale is large enough for the fee to be very low). Rhys says: I suggest that you include in your study the fund manager’s personal funds as part of analysis. I suspect what you will find is that the higher % of own capital of a fund, the more the fund manager will accept zero management fees and focus on performance fees. We think Rhys is right.

5 Daniele Scilingo from Baar, Switzerland has a Listed equity note nanos.ch that invests in a concentrated portfolio of 10-15 Swiss compounders. No management fees, 5% hurdle pa, 25% performance fee above hurdle. High watermark of course with yearly payments.

6 Igor Vasiliev from Russia http://www.igorvasiliev.com/says: I don’t take management fees and only charge clients from the profits received. We set it at 30%.

7 Fabian Schilcher comments that from memory Khrom Capital, Monte Sol Capital and Greenhaven Road Capital should be included in our study. All three are value centric so we tend to agree..

8 Greenhaven Road Capital’s Scott Miller greenhavenroad.com weighs in from New York. For the first six years of the fund we have not charged a management fee. I am actually looking at layering in one for new capital to end up with a blend of management fee paying and non-fee paying. Jake Rosser of Coho Capital just put one in – he has beaten the S&P 500 my a significant margin, but gotten paid only two out of nine years (he also has a hurdle rate). Mark – Why do you think no management fee is the way to go?

Yes, it is investor friendly and aligned – but getting paid 2 out of 9 years cannot lead to optimal decision making. There is the health of the investor and the net investor returns to be balanced. 2 and 20 is really not investor friendly and turns a 10% gross return into a 4% net return – however a modest management fee (75 basis points) and a hurdle rate feels optimal to me. As an investor, why do I want my PM to get paid two out of 9 years while still beating the market? I am literally in the process of writing the letter adding a management fee for new funds invested – I may or may not ultimately end up on the list – the siren songs of the stability of a management fee is weighing on me.

9 CVPLP (Cook Value Management LP) privatevaluelp.com is managed by Michael Cook, who comments.

Our class B shares have no management fee, a 6% hurdle rate and 25% incentive fee on excess returns above the hurdle. Also, last year I invested some capital for my family trust with Scott Miller who runs small cap fund Greenhaven Road Capital Fund 1, LP. He has a long-term share class with no management fee and a hurdle rate/incentive fee structure, which is the share class I invested in.

10 Rafael Abreu, who runs Köli Fund https://br.linkedin.com/in/rafaelabreu from Rio de Janeiro, Brazil is inspired by stories about Warren Buffet, mentioned in Guy Spier’s book. His new venture will not charge a management fee, will charge performance fee based on a 3%/year hurdle instead of 0%, with performance fee payments made only if, on a 3y rolling window, performance beats cumulative hurdle.

The idea is to be paid only if I am able to add value and in order to do that I believe I must offer an investment vehicle that doesn’t cost clients to wait while we are looking for opportunities which aren’t present all the time. I strongly believe in longevity in the industry, thus allowing for compounding of returns, incentives must be aligned in order to keep clients at ease, in a relationship of trust which then will enable the money manager to actually focus on opportunities instead of managing expectations, etc.

11 A former client suggests Jagpreet Bhatia , of Value Architects Capital Advisors from New Delhi, India who runs a Buffett style partnership https://iaip.wordpress.com/tag/value-architects-capital-advisors

12 Aaron Westlund has managed a small Washington state-registered investment adviser to a value-oriented fund in business since 2007. The adviser is Poorman Creek Capital Advisors, LLC and fund is Poorman Creek Capital Fund I, L.P.:

Odd name for a fund I know; that’s really the creek I grew up on, and part of the thinking was that it might make hot money think twice before investing with us. Our investment strategy is quite turtle not hare. We charge no management fee, and only a performance fee. The performance fee is 25% of the excess of fund return over S&P 500 total return, on a cumulative basis. The genesis of that is largely twofold: One, it’s just a matter of principle – if I’m managing your money against an otherwise easily achievable benchmark, I should only be compensated on outperforming it, which is the only reason an investor is investing in the fund in the first place. Two, when I launched the fund, my formal professional background was technical and financial reporting issues (GAAP accounting) not investment management. So, I was quite hesitant to “learn on someone else’s dime”. Finally, an adjunct that heightened both of the above was that my initial investors were principally friends, family, and other close colleagues, some of whom were not as well off as I was. And if there’s anything to help clarify your principles in this business, how they affect those you care about most might be it

13 Jean Phillippe Tissot has for the past 4 years run and managed a family/friends portfolio, set up the same as the Buffett’s partnership – No management fee and only performance fees after a hurdle rate of 6%.

14 Thai Capital Management believes that investors should not have to pay for bad services. Therefore, they do not charge a management fee and seek to benefit only when they have generated profit for their investors says Danny Thai.

15 Devraj Dhagat runs Coast Redwood Advisors Pvt. Ltd. a SEBI registered Portfolio Management Services company investing in the Indian stock market:

Our philosophy is based on Value Investing. We are fanatic about research and are constantly in search of stocks at cheap prices. We mainly get these opportunities when there is pessimism and uncertainty in the market. Our utmost priority while investing is safety of principal amount. We are not only focused on the profit but also on not losing money. We are able to achieve our investment targets by having the right balance of confidence and humility. We think humility is the most important lesson in investing. That is why we check and recheck our analysis before coming to any conclusion. What makes us different is that we are genuinely long term oriented, we are genuinely passionate about stocks and we genuinely manage other people’s money as if it is our own money.

16 Johan Bynelius from Fair Investments in Stockholm, Sweden fairinvestments.se/kapitalforvaltning/spets/ says 25% performance fee and pays all transaction fees.

17 Dan Brocklebank comments I’m not sure if this is what you are getting at but at Orbis https://orbis.com/ we have fee structures that have zero base components and which only charge a fee if we outperform the index (e.g. MSCI World Index for the global strategy). That fee is also not paid to us immediately and is held in a reserve and available for refund in the event of subsequent underperformance.

18 Lupoff Friends and Family http://www.lupoff.com/ will commence investing this year with a zero-management fee, high conviction portfolio says Peter Lupoff from New York. Performance Fees are 25% after a preferred 5% return. I’m ex Marty Whitman’s Third Ave Funds and Izzy Englander’s Millennium. I ran Tiburon Capital Management for the last 7 1/2 years and converting to Lupoff Friends and Family.

19 Ryan Lundeen started Lundeen Capital https://www.linkedin.com/in/ryanlundeen in 2016.

In addition to having over 90% of my net worth in the fund (~50% ownership), I do not charge a management fee. It makes absolutely no sense to be paid if I do not perform.

Ironically, he is based in Omaha.

20 John Price manages the Conscious Investor Fund in Australia. It is a wholesale fund which, in Australia, basically means that the minimum investment is $500k.

“We do not have a management fee based on FUM in the usual sense. Instead, we have a nominal monthly membership fee of $450 no matter how much you invest whether it is $500k or $5m. So, the monthly membership represents 0.54% for an investment of $1m or 0.11% for an investment of $5m. Our investors like the idea of a membership. They feel more included in what we are doing. The membership partly covers basic administration costs. http://consciouscapital.com.au/fund/why.html”

21 Yair Gordin mentions Ovis Capital https://www.ovis-capital.com/ and Eden-Alpha https://www.eden-alpha.com/

22 Ken Lee suggests Meb Faber, CEO/Founder of Cambria Funds, from El Segundo, California, which charges no management fee. http://www.cambriainvestments.com

Ambérd Capital http://www.amberdcapital.ch/ is a Swiss based wealth management and advisory company established in 2014 writes Levon Babalyan.

We manage separate accounts and charge only performance fees. We make no money by just “overseeing” assets. We make money only when clients make money. All loses are carries forward.

23 At iolite iolitepartners.com Zurich-based manager Robert Leitz tries to keep things simple and stick to time-tested value investing strategies running a concentrated portfolio of global value stocks and bonds. He is not charging a management fee but a 25% performance fee over a 4% hurdle with an applied high watermark.

24 Raymond Rodriguez from Coral Gables, Florida runs Aragon Value Partners aragonvp.com. No management fee or administrative fee with a 20% performance fee on a soft hurdle of 5%.

25 Ray Mirza from New York launched LevelPar Capital in May 2016.

I wrote a letter to Guy Spier in 2015 because I was waffling on whether to start the Fund or not. He replied and basically said, ‘Go for it’. Our Fund structure is modelled after the old Buffett partnerships where we don’t charge a management fee but have a 25% incentive fee

26 Sean Miller from Miller Asset Solutions LLC in Charlottesville, Virginia says that his website, millerasset.com states:

I do charge either a fixed fee of standard 1% or a performance-based fee of 0.70% + 20% of annual profits. Many of my clients, at a larger asset level, have decided to be on a straight 20% of annual profits.

He believes that he is the only RIA in Virginia not to charge a performance fee.

27 Harvstburg Capital Special Situations Fund, run by Sebastian Steusloff in Bad Soden, Germany harvstburgcapital.com notes:

We do not charge management fees in our Special Situations fund.

28 Amol Amin’s fund is Woodmere Partnership based in New Jersey, USA woodmerepartnership.com.

I started with the classic Buffet set up of 0% / 25% over a 6% hurdle, and added a long-term lockup feature. My reason for this is I think it’s the fairest and simplest structure for both me and my partners. It also helps attract and self-select for the kind of partners I want because to be comfortable with my structure requires you to understand why I want and believe in a one-man fund as well as be fully aligned with my investment strategy.

29 Gregg Barrett says QTS Capital Management from Niagara, Ontario, Canada does not charge a management fee. http://www.qtscm.com/

30 David Shapiro refers to Gary Channon of Phoenix Asset Management based in London which has a zero fee for quoted UK investment trust Aurora Investment Trust. https://www.aurorainvestmenttrust.com/

31 Gwen Cheni says:

We charge zero management fees for our hedge fund, Lake Geneva Fund out of San Francisco for a three-year lockup. The thesis is to buy innovative tech companies that later get acquired by large legacy corporations playing catch up. We’ve just had our 21st acquisition in three years.

32 Francisco Olivera runs a small value-focused Hedge Fund in Puerto Rico through Arevilo Capital arevilocapital.com.

We have the same Buffett partnership structure. No management fees, 25% of profits above a 6% annual and cumulative hurdle.

33 Christian Olesen, the investment manager of the Olesen Value Fund says:

We are planning to change our fee structure in the next couple of months to give our investors two options: 0 and 25, or 1 and 20. We have been charging 1.75 and 20 so far.

34 Mike Hayhoe references Dave Barr of Pender out of Vancouver, with his Pender Select Ideas Fund. He says it does not charge a mgmt. fee, just a 25% performance fee above a 6% hurdle with a perpetual high water. http://www.penderfund.com/alternative-funds/pender-select-ideas-fund/

35 Anish Teli runs a pool of managed accounts in India for clients which invests in long only equity with longer time frame holding periods.

To align with clients interests I don’t charge any fixed management fee. There is only a performance fee above a hurdle rate with a high-water mark. This is why the firm is called QED Capital where QED stands for “Quad Erat Demonstratum

He believes in charging a fee only when he has demonstrated that he has made returns for his investors. www.qedcap.com

36 RLT Capital’s Stephen Pomeroy from Phoenix, Arizona rltcapital.com started small 3 years ago, with family investment only. Have since grown in terms of both AUM and number of outside investors, but still have significant scaling to do going forward.

37 Rajeev Agrawal tells us that DoorDarshi Value Advisors doordarshiadvisors.com/ is a firm focused on investing in Indian equity.

The main aim of the firm is to make money along with investors rather than from them. This principle borrows heavily from what Warren Buffett has expounded over more than half a century. Our fee structure is similar to Buffett’s partnership structure. We subscribe to Value Investing philosophy and have gradually moved from cigar butt approach to buying and keeping business that have a long runway in front of them. Once again Warren’s teaching of “Easy does it” makes the most sense to us. When we find a business with a long runway and a management which can be trusted we would want to hold the position for a very long time even if it looks expensive at certain times.

38 David McLean advises us about his ROMC fund http://mamgmt.com/ out of Toronto – managed to get positive results even in 2008-2009. Searches for value but in high quality companies. More modern Buffett vs cigar butt Buffett?

39 Saltlight Capital’s David Eborall from South Africa saltlight.co.za reveals:

I currently do not charge management fees. Only fund compliance costs and a performance fee over a hurdle rate.

40 Darren Maupin is the Investment Advisor to the Pilgrim Global ICAV in Ireland pilgrim-global.com He charges zero management fees but a 20% performance fee over a 5% compounding hurdle, HWM etc.

42 Mathew Peterson in turn introduces an emerging manager Brian Taylor who runs a value based zero management fee fund BPT Investment Partners Fund in Minneapolis. Mathew adds that his own Peterson Capital Management does not yet qualify as zero-management, with our 0.9% management fee. I plan to drop the management fee once I have a little bit of operating cushion.

43 Stefan Rehm from Germany tells us that in April 2013, he founded SR Value GmbH which tries to apply a professional Value Investing approach in a concentrated (Dhandho) manner by investing into the best available long value ideas. No Management fee. A 6 % compounded hurdle rate over five-year periods and then 25 % of profits over that 6 % compounded hurdle. srvalue.de

44 Steven Check of Check Capital Management Inc. in Costa Mesa says:

We charge our clients a 10% performance fee with high-water marks. We charge no management fee. checkcapital.com

45 Carbon Beach Asset Management AcquirersFunds.com is run by Tobias Carlisle, who says:

Deep value and special situations managed accounts. 0% management fee and 20% of gain over high watermark.

46 Swell investments, swell-inv.com is an Israeli based long short hedge fund run by Sagi Begas and Eron Amit which invests both in the Israeli Markets and Shares and shares in the US and Europe.

We have no management fee and a 25% success fee.

47 Karlo Teran says:

I am pretty sure that one of my friends from Mexico, Juan Matienzo, charges no management fee. I think that he is the only one that does it full time.

48 Sarvesh Gupta of Maximal Capital (maximalcapital.com) tells us he is starting an equity investment advisory firm in Mumbai, India for domestic investors in India (mainly HNI’s) with zero management fee and all fees dependent on performance of the portfolio advised (as a % of profit with a hurdle). He wrote:

I am charging a zero management fee and a zero set up fee (it’s common in India to charge 1-2% initial one time fee as a % of amount invested for incoming clients). I am only going to charge a performance fee over a hurdle (which may vary depending on clients). As hurdle rises, profit share over hurdle increases and vice-a-versa. The hurdle in my case is a compounding hurdle with high water-mark. While obviously there are risks in this structure, very well elucidated in the draft document – the overarching theme is that if I were an investor, what I would ideally want from a fund manager is a complete alignment of interest, and its Maximal Capital’s endeavour to provide the same. In fact we have gone one step ahead and the idea is that a large % of my net worth is also invested alongside the investors in roughly the same weightages (this is a managed account firm and not a fund) – so we also eat our own cookies.

As alpha generation in India (dominated in the equity segment by MFs), particularly in large caps, is steadily coming down, I see the industry shifting towards managers who make money out of profit share over a hurdle which sets the right incentive (Charlie Munger will agree) to produce returns rather than do asset accumulation (which is an overpowering illness in more than 90% of the Indian equity asset management industry as of now).

49 Kenny Arnott runs Arnott Capital http://arnott.com.au/. A long / short hedge fund with Aussie focus and he has a story:

I founded the company in 1999. I launched external funds in 2005 seeded by Paul Tudor Jones and ran up to USD 900 million. I made positive 1.62% after fees in 2008. Nevertheless, I still had around 40% redemptions that December. I handed the money back in 2010 and took a break. Anyway, I have been running my own capital for a while and am now relaunching to outside investors again at 0 and 25%. Since starting in 1999, I have never had a losing year.

50 Konstantin Leidman suggests Neil Woodford of Woodford Patient Capital. https://woodfordfunds.com Thanks Konstantin – I checked and yes – no management fees.

52 Brian Hirschmann’s fund, Hirschmann Capital, hirschmanncapital.com is a US$10mm fund in Los Angeles that doesn’t charge management fees. They were recently mentioned in a Valuewalk post.

53 Mike Loftus at Loftus Metolius Capital metoliuscapital.com is a CTA just west of Chicago in Wheaton, IL. Their Metolius Enhanced Fund charges 0/25%. The firm total AUM is $177 mln, $108 mln of which is Principal and Employee money. They are heavily invested in the fund and launched the Enhanced Fund with no management fee in 2015.

54 Levon Babalyan runs Amberd Capital: www.amberdcapital.ch – he does not charge a management fee and only a 10% performance fee after a hurdle, which is set at the rate of inflation. He has most of his net worth invested in the strategy and manages separate accounts.

55 Ray Mirza runs LevelPar capital.. He writes:

“I don’t charge any management fee and take a 25% performance fee Guy Spier was one of the inspirations for me starting LevelPar Capital in May 2016. I wrote him a letter two years ago and your replied and he told me to go for it.

The fund had a great year in 2016 and we are having another decent year in 2017. We only have $1.5 million in AUM, but hopefully we can build on it in the future.”

– – FURTHER COMMENTARY – –

Having distributed this document to a small group we received some further valuable commentary:

Mark Weidmann wrote:

“I started my fund in May of 2009. Prior, I wrote to Warren Buffett for the fee structure he felt was fair, and followed what he suggested when he wrote back: no management fee, 25% of any gain above 6%, and a high water mark – If the fund loses money one year, it has to make up that amount, then make 6%, and then I take any gains above 6%.

I do agree with the principles of investing laid out by Warren Buffett and attempt to follow them.

I manage $15,000,000 of which $3,000,000 is my own. I also have additional $4,500,000 in retirement accounts that I invest in the exact same way and same securities as the hedge fund. I have simultaneously run a law office, although I may wind them up soon.”

Tony Hansen added:

“Another factor you will find commonplace in zero fee managers is their willingness to restrict the size of their AUM, to ensure they can generate returns at a level that will be sufficient to generate performance fees. They are far less prone to becoming ‘asset gatherers’ as this could potentially reduce their capacity to earn fees.

To this end, my own fund ‘soft-closed’ at $50m (i.e. only existing unitholders can contribute further) and will ‘hard-close’ at $100m (i.e. no further additions – save for a once annual offer to replace redeemed funds).

This relatively modest AUM will allow me the long runway I seek (30-40 years) with excess size not likely to become an impediment for many years.”

– – OTHER SOURCES – –

Alfred Winslow Jones https://en.wikipedia.org/wiki/Alfred_Winslow_Jones

The Jones nobody keeps up with – Carol Loomis in Fortune Magazine – 1966. http://fortune.com/2015/12/29/hedge-funds-fortune-1966/b