1 Introduction and Disclaimer

- This white paper is the product of my time interning for Guy Spier. As a young woman of Indian descent and an aspiring businesswoman who has spent time in other parts of the planet, I have seen the world change before my eyes, especially in terms of its variety of markets, in ways that have impacted myself and those around me. Having lots of exposure to the consumer product market in India, I was deeply interested in exploring the ins and outs of this trade, and how it is going to adjust to global economic and social phenomena.

- This of course, is a conversation starter and jumping-off point. I do plan on revising this document and am always open to hearing other perspectives on this topic to deepen my understanding. Feel free to contact me via email with any and all ideas, questions, and feedback!

2 Overview of India’s Consumer Market

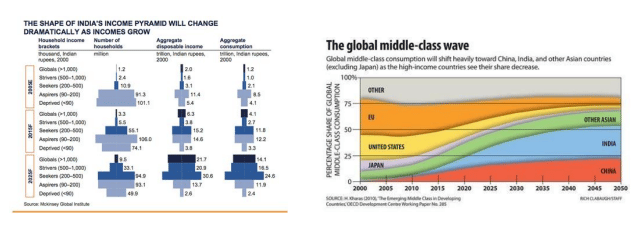

- India, the second-most populous country, has the sixth-largest world economy and is set to become the world’s third-largest consumer market. A report by the World Economic Forum predicts that India’s consumer spending will, by 2030, grow from $1.5 trillion to $6 trillion. Its GDP growth rate is currently 7.4%, with 60% of this accounted for through domestic private consumption. At its current standings, India is regarded as a “bottom of the pyramid” economy, however with the exponentially increasing consumer market that is fueling the country, the middle class will continue to grow and will eventually lead the country’s economy.

- With a population of 1.3 billion people, India’s main market for consumer products will be geared toward those in highly populated cities and small rural towns. The expansion of retail products, especially online retail, is going to continue as the markets and demands for these products, such as cosmetic products, perishables, and household products, thrive. This will ultimately lead to an improvement in infrastructure in rural areas as access to stores and roads develops.

- The rapid growth of India’s consumer goods market is primarily due to a few key factors: rising incomes, growing middle class, and broad-based growth, all of which are deeply interrelated. By 2030, with almost 25 million homes lifted out of poverty due to the rising incomes and the growing middle class, the many Millennials and 1 billion+ internet users will propel India into a technologically driven consumer business model.

3 A Fast-Growing Leader: Patanjali

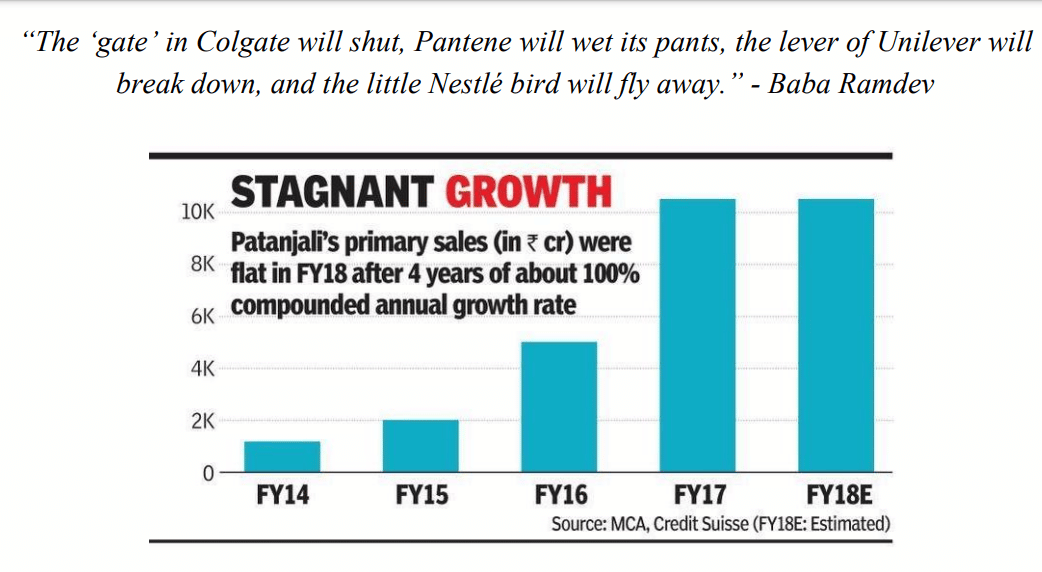

- One such company that is dominating the consumer products market in India is Patanjali Ayurved Ltd., which although it was founded merely 13 years ago in 2006, has grown immensely throughout India in the FMCG (Fast-Moving Consumer Goods) industry. It is the fastest-growing company in Indian consumer goods. Since 2012, Patanjali’s revenue has increased twentyfold from $69 million to $1.6 billion. This quickly skyrocketing company is even expected to surpass substantial multinational companies such as Nestle or Unilever in the near future.

4 Why Should You Care?

- There is a large number of FMCG companies within India, but what makes Patanjali innovative is that it has reformed strategies utilized by traditional FMCG companies to reach a wider audience. For example, Patanjali has one umbrella ‘Patanjali’ brand that it adheres to when creating and marketing products. Contrastingly, most FMCG companies tend to create new subsidiary brands and companies that reach a variety of consumers in different sectors.

a)Advertising Strategies

- While many companies, such as Lululemon or Red Bull, have successful ambassador programs that invite individuals to have formal relationships with brands for advertising purposes, very few have a sole figure that drives all sales. Meet Baba Ramdev, the yoga guru who is represented in all Patanjali products Piya Garg How Fast Moving Really is India’s Consumer Market? [email protected] and advertising campaigns and is described as being “on a three-axis chart of holiness, capitalism, and lumbar flexibility.” The purpose of using him is to create a sense of personality and familiarity when it comes to Patanjali products.

- A wide range of consumers associate the Patanjali brand to this caring, healthy figure that assures customers that the products are of good quality. Interestingly enough, Baba Ramdev does not actually own any shares or earn a salary, yet he is still the first thing people think of whenever someone utters the name ‘Patanjali’.

The revered Baba Ramdev (right) acts as the trusted figure representing the Patanjali brand, drawing onthe pathos aspect of the company’s advertising approach.

- The company’s actual advertising strategy was for the most part quite minimal, only really utilizing the Baba Ramdev figure to pull customers into the brand. However, recently Patanjali is innovating their approach by heavily advertising on TV channels and opening up exclusive Patanjali stores throughout the country. Spending Rs 570 crore (~$83 million) on advertising and promotion in FY17 with an annual revenue being Rs 9000 crore, Patanjali has become the third-largest advertiser on Indian television.

- Furthermore, through Patanjali’s online e-commerce platform, customers from all over India, regardless of whether a physical store is in their vicinity, can have access their products, as well as blog posts and healthcare tips, which incorporate the products of their ‘natural-based’ brand.

b)Low Prices and Low Costs

- A major advantage that Patanjali has in comparison to other FMCGs is their low prices, which is accounted for by their low overhead expenditure on things such as management professionals or distribution costs.

- Products such as honey, facewash, and noodles have significantly discounted prices. This is also true for most of their other products, except for ghee. These lower prices undoubtedly give Patanjali the upper hand in appealing to the masses, particularly because a majority of other FMCG companies charge as much as possible as they are profit-oriented.

c)The Ayurvedic Side: Turning a New Leaf

- Specifically in India, more and more companies are jumping on the ayurvedic/natural product trend in attempts to draw more customers to their brands. Ayurveda, a form of natural medicinal therapy that grew popular in South Asia, is being taken advantage of by large firms such as Patanjali, Hindustan Unilever, and Colgate-Palmolive. Issam Bachaalani, Managing Director of Colgate-Palmolive, stated:

“As consumers and lifestyles evolve, so do the benefits that consumers seek. Currently, the segment that is growing the fastest is naturals — a current consumer trend not just in India, but the world over.”

- The natural/ayurvedic product market in India is expected to grow from $500 million to $1.1 billion by 2021, according to TechSci Research, and Patanjali is already a major leader in this field both in India and globally, as they capitalizedon this trend early on.

- Furthermore, Patanjali is innovative in that they have combined popular goods and trends in order to maximize their sales potential. For instance, with the rise of urbanization and Westernization in India, there has been an increase in the demand for personal care products such as hair oils, skin lightening products, hair removal creams, etc. Taking advantage of this trend, as well as the growth of Ayurveda, results in an entire sector of Patanjali goods coined ‘Natural Personal Care’.

5Future Prospects

- In FY18, Patanjali’s sales have slowed due to the supply chain and distribution network being unable to keep up with the company’s fast growth, as well as struggles with coping with the GST (Goods and Services Tax) in India.

a) Obstacles

- Baba Ramdev’s tendency to be involved with a multitude of scandals could have a negative impact on Patanjali’s sales and popularity. As the company’s spokesperson and public figure is the main strategy that they rely on to continue to drive their sales, any negative connotations regarding Baba Ramdev would take a toll on Patanjali. For example, Baba Ramdev has claimed that yoga can “cure” homosexuality, which is problematic, especially given that the acceptance and embracing of the gay pride movement in India is becoming more and more prevalent with each passing day. Furthermore, his recent comments about wanting to ‘behead those who did not support and chant nationalist slogans’ earned him several non-bailable warrants.

- Another potential obstacle in the long run is the fact that huge, longestablished FMCG companies such as Hindustan Unilever Ltd., Dabur, and Emami are quickly catching up to Patanjali, specifically in their sales and marketing strategies. In response to Patanjali’s focus on herbal products, in this case herbal toothpaste (Dant Kanti) and consumers’ tendencies to purchase herbal/ayurvedic products, Colgate has released an herbal toothpaste (Cibaca Vedshakti) priced cheaper than its other products.

- Furthermore, the potential of overlapping products between companies, such as honey, hair oil, chyawanprash, etc., could prove problematic as customers’ loyalties may waver depending on price and quality.

- It is instances like these, coupled with Patanjali’s recent slowing sales, that will become a detriment to the company’s growth in the future if they do

not adequately reform the way they structure their branding, as well as their supply/distribution strategy.

b) Opportunities

- As mentioned earlier, as the natural/ayurvedic product market continues to grow rapidly, a lot of opportunity for the development of Patanjali arises.

If they continue to take advantage of products trends and merge them in an impactful way, Patanjali will extend its reach to a wider range of

consumers. - Similarly, a large part of the target audience demanding natural products are Indian communities living in rural areas. As of late, Patanjali has not placed a significant amount of resources into expanding operations to rural India, which could prove to be a massive opportunity in marketing natural products at a low price.

- The prevalence of packaged edible goods is already proving to be beneficial for Patanjali’s sales, seeing as their most popular products are

ghee and noodles, but a sector of food business they are yet to look into is quick restaurants. Patanjali could follow in the footsteps of large companies such as Haldiram and open restaurants that utilize and complement existing Patanjali products to garner new, more permanent, customers.

c) What’s Next for Patanjali?

- As of February 2019, Patanjali is on its path to restructuring the way it leads its business, following in the footsteps of other large FMCG companies and beginning to classify key product categories, such as noodles and biscuits, under different group companies. This expansion may lead to an extended target customer base, and ultimately help to further grow their company.

- In terms of future business plans, Patanjali claims that they are transitioning the company into a non-profit organization and wanting to boost their business by partnering up with foreign venture funds in hopes of continuing to make money while winning the hearts of customers throughout India

d) Eastward Expansion

- This is not to say Patanjali is only to remain in India, however. Since 2017, the FMCG company has been looking to expand their company outreach throughout the rest of Asia, in countries such as China, Myanmar, and Bhutan, as Patanjali has already been exporting their goods to the US, UAE, and some European countries.

- Particularly in China, the most populous place on the planet with very high consumption levels, Patanjali has potential to grow. China’s largest FMCG company is currently WH Group, which specializes in meat and food processing. With the introduction of Patanjali, the wide plethora of available products can be beneficial as a ‘one-stop shop’ to the consumers there.

6Conclusion

Following this extensive research into the world of Indian consumer products, and Patanjali in particular, I strongly believe that this market is going to continue to grow at an increasing rate. Especially due to factors such as the ever-enlarging middle class in India, as well as the constant pressure from other companies to expand their business to more countries, Patanjali and its business model are on the correct path. Although there are obstacles that could obstruct their success, such as negative controversies and an increase in competition, these things can undoubtedly be alleviated in the long run. As long as Patanjali appropriately handles the immediate negative publicity and perhaps restructures their marketing strategy to rely on Baba Ramdev into a lesser extent, I think that there is a lot of potential. There is no doubt that the consumer product market is booming, and with potential plans to announce an IPO, the future of Patanjali is just beginning

Experts

- Acharya Balkrishna

https://www.linkedin.com/in/acharyabalkrishna/?originalSubdomain=in - Baba Ramdev

https://www.linkedin.com/company/baba-ramdev/about/ - Issam Bachaalani

https://www.linkedin.com/in/issam-bachaalani-4a27ab3/ - Sanjiv Mehta

https://www.linkedin.com/in/sanjiv-mehta-100b1518/?originalSubdomain=in

Sources

- https://www.bain.com/about/media-center/press-releases/2018/wef-india-consumption-report/

- https://economictimes.indiatimes.com/news/economy/indicators/india-poised-to-become-third-largest-consumer-market-wef/articleshow/67450935.cms/a>

- https://www.bloomberg.com/news/features/2018-03-15/this-multibillion-dollar-corporation-is-controlled-by-a-penniless-yoga-superstar

- https://www.bloomberg.com/news/features/2018-03-15/this-multibillion-dollar-corporation-is-controlled-by-a-penniless-yoga-superstar

- https://economictimes.indiatimes.com/industry/services/advertising/patanjali-spent-rs-570-crore-on-advertisment-and-promotions-in-fy17/articleshow/62922635.cms?from=mdr

- https://www.prnewswire.com/news-releases/india-hair-care-market-outlook-to-2023-300661813.html

- https://economictimes.indiatimes.com/markets/stocks/news/patanjalis-impact-on-fmcg-cos-seen-limited/articleshow/53765232.cms

- https://economictimes.indiatimes.com/industry/cons-products/fmcg/supply-distribution-could-not-match-fast-growth-at-patanjali-acharya-balkrishna/articleshow/68041253.cms

- https://indianexpress.com/article/india/non-bailable-warrant-against-baba-ramdev-in-beheading-remark-case-bharat-mata-ki-jai-ramdev-beheading-4704403/

- https://www.freepressjournal.in/business/baba-ramdevs-patanjali-goes-abroad-plans-to-expand-to-east-asia-including-china

- https://economictimes.indiatimes.com/industry/cons-products/fmcg/why-companies-like-hul-patanjali-dabur-are-taking-a-crack-at-the-market-for-ayurvedic-and-herbal-products/articleshow/61084207.cms?from=mdr

- https://timesofindia.indiatimes.com/business/india-business/once-a-disrupter-patanjali-faces-slowing-sales-study/articleshow/65329858.cms

- https://www.weforum.org/agenda/2016/11/6-surprising-facts-about-india-s-exploding-middle-class/

- https://india.blogs.nytimes.com/2013/05/13/indias-middle-class-growth-engine-or-loose-wheel/

- https://www.dnaindia.com/business/report-5-products-that-make-baba-ramdev-s-patanjali-ayurveda-firm-worth-crores-2579442

- https://www.kirana99.com/

- https://entrackr.com/2018/01/french-invest-baba-ramdev-patanjali/

Author’s Short Bio

Piya Garg is a High School student, currently attending The American School in London. Hailing from an Indian-originating family who grew up in Hong Kong, her global perspective is unique, in that she is able to leverage her language skills, such as Hindi and Chinese, to navigate through research on a variety of markets and topics. She has interests in Business and Economics, which manifests into the multiple start-up companies she is a part of. In addition to this, Piya enjoys traveling, trying new foods, and social justice endeavors.