Introduction

a refreshing conversation with Guy Spier during my internship at Aquamarine Capital, we discussed what it is I would like to write my white paper about. With relatively little discussion on the direction of the paper, the overarching theme was “I want to know how I can make money, or save money.” This paper plans to explore how this might be done in the changing economy soon to be engulfed by Gen Z.

1 Glossary

| Term | Definition |

| Admitted (Company) | An insurance company authorized by the state regulator to sell insurance within a US State |

| Captive Insurance | An alternative form of self-insurance where a parent company creates a licensed insurer to provide coverage |

| Combined Ratio | A measure of underwriting profitability by the insurer in the form of losses and expenses Excess & Surplus Reference to the specialty insurance market where tailored contracts are created to meet limits for difficult exposures |

| Expense Ratio | A measure of profitability by calculating acquisition, underwriting, and servicing expenses for a contract |

| Insurance-linked Security | A financial instrument whose values are linked to insurance loss events |

| Loss Ratio | A measure representing insured losses to premiums earned |

| Managing General Agent (MGA) | A specialized insurance agent with underwriting authority |

| Policy | The written insurance contract held by the policyholder |

| Reinsurance | A company that provides financial protection to insurance companies by acquiring risk from them |

| Retrocession | The transfer of risk from a reinsurer to another reinsurer |

| Run-off | Insurance contracts that are no longer written but have yet to expire |

| Underwriting | The process of accessing, pricing, and taking on a risk for a fee |

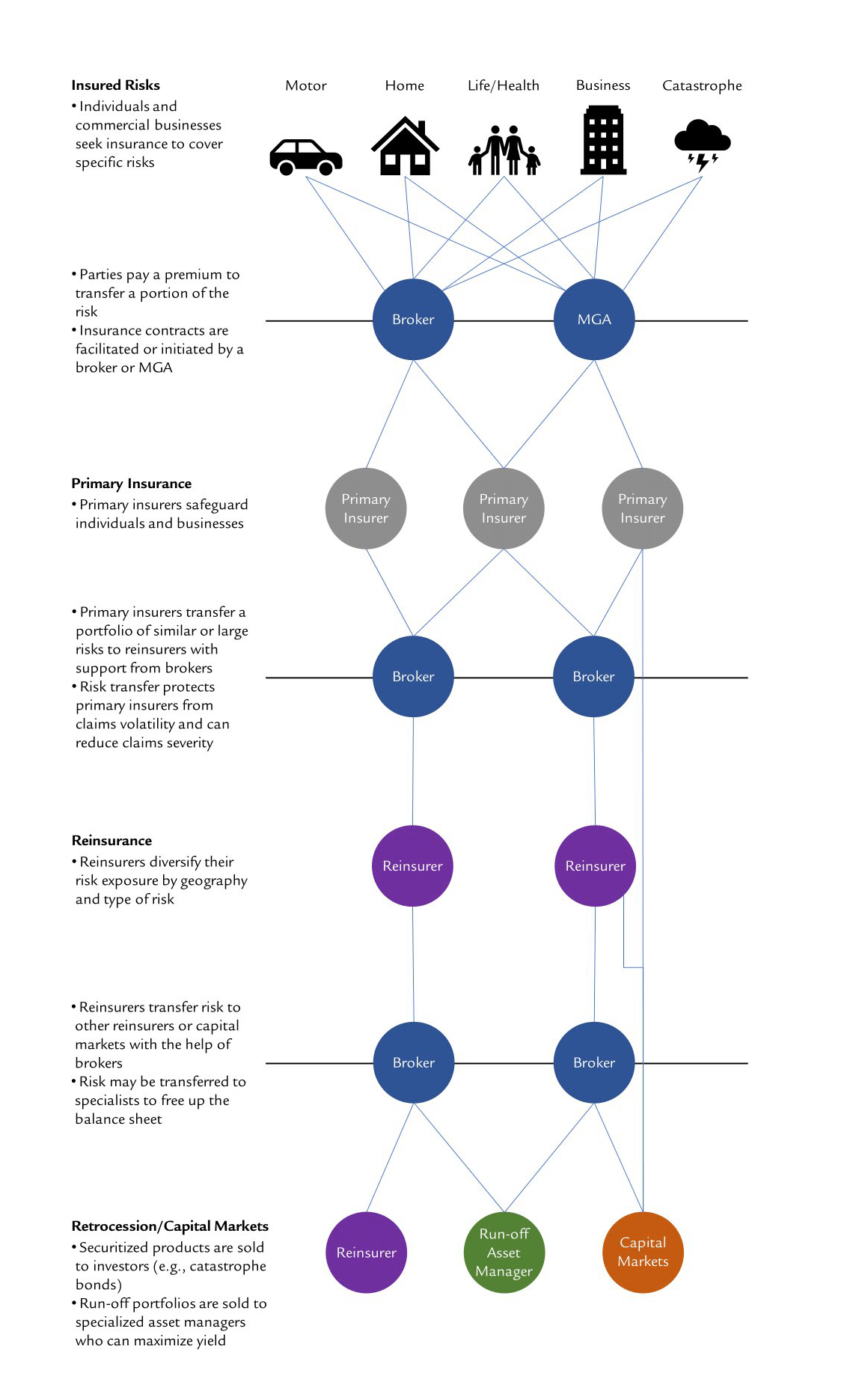

2. Insurance Value Chain

Insurance is not usually written directly with the insured. Rather, it is done through intermediaries such as a broker or managing general agent (MGA). An MGA can write insurance contracts which it then sells to insurers, while brokers cannot. Brokers and MGAs facilitate the transfer of risk.

There are multiple levels in the highly regulated insurance value chain. A whole balance sheet is sold when a contract or portfolio is sold. This is because of the asset and liability matching constraint imposed by regulators.

Over the last decade, brokers have been the most profitable stakeholders in the value chain. All others broke even or suffered losses. The unequal distribution of value is attributed to the cyclicality of the industry. Premiums decrease when there is an oversupply of capital available to underwrite risk. The sustained low-interest rates since 2009 supplied too much capital.

Natural catastrophe (NatCat) claims caused underwriting losses for the property and casualty (P&C) business. Low-interest rates for the life and health (L&H) business provided an inadequate return on equity. Now, the industry started to increase premiums after revaluating excessive losses. The industry is starting an upward trajectory. Now is an ideal time to buy cheap balance sheets from MGAs and run-off portfolios. Cheap balance sheets will yield a superior return due to increasing premiums and rising interest rates.

There are four geographic locations that host a large concentration of (re)insurance companies. These cities or countries have become

London

London is a large insurance hub because of Lloyd’s of London position as the oldest insurance marketplace in the world. Established in 1688, Lloyd’s still leads the industry in complex risk and specialty underwriting. It facilitates an insurance market for underwriters and brokers. The market operates with syndicates that capital provided by financial institutions back. Lloyd’s does not act as an insurer.

Bermuda

The island nation of Bermuda became a hub for insurance in the early 2000s due to its proximity to the U.S., comprehensive regulatory policies on par with Europe and the U.S., strong common law rule, and a low tax environment. Bermuda is focuses more on the reinsurance side of the industry, well known for underwriting low frequency, high severity risks like natural catastrophes. The high concentration of insurers and brokers, makes insuring risk convenient in the small nation. However, in recent years Bermuda has seen a decline in insurers staying on the island, partially due to the increasing severity and frequency of costly natural catastrophes and the high cost of living coupled with the limited talent pool.

Zurich

Zurich officers insurers a continental Europe hub. Located in central Europe with access to a highly skilled talent pool, insurers based in Zurich take advantage of short travel times to visit clients in other European countries while benefiting from an attractive corporate tax environment. Strong and efficient bureaucracy complemented by a reputable financial market authority further boosts the Swiss hub’s reputation globally. Historically significant, Zurich is home to major global players such as Zurich Insurance, Swiss Re, and Swiss Life.

Singapore

Singapore holds a similar position to Zurich in South East Asia. Its developed economy and rule of law are complimented by a low tax environment, attractive for large insurers to set up shop. Its proximity to major developing economies in the area is a tremendous opportunity to capitalize on growth in the future. Hong Kong is a similar Asian hub but is mainly used to address business opportunities in mainland China. Historically, insurance businesses in China have been difficult to build because of government regulations.

4. Insurance Environment

The insurance and reinsurance industry is highly competitive, and through industry consolidation, has become even more competitive in recent years. Insurers and reinsurers compete with international and domestic insurance companies, mutual companies, specialty insurance companies, underwriting agencies, government-owned or backed facilities, European underwriting syndicates, and diversified financial services companies. Furthermore, alternative capital sources provided through insurance linked securities increasingly compete with reinsurance companies. Due to the low barriers of entry, especially in the property and casualty (P&C) lines, new companies call “Insurtechs” enter the industry with disruptive technologies or business models.

Competition takes the form of lower prices, broader coverage, greater product flexibility, enhanced digital capabilities for distribution of insurance products, higher coverage limits, higher quality services, higher ratings by independent rating agencies (e.g., A.M. Best, Standard & Poor’s, Moody’s). Market conditions, risk tolerance, and capital capacity primarily influence the degree of competition. The performance of P&C lines in both insurance and reinsurance industries has historically tended to fluctuate cyclically between periods of price competition due to excess underwriting capacity followed by periods of high premiums due to a shortage of underwiring capacity .

Non-life insurance lines, on a global level, have experienced steady real premium growth since 2009 while growth in life insurance lines has been more volatile. In 2020, global real premium growth for life insurance lines decreased by 4.4 percent , heavily impacted by a double digit fall in some developed markets , due to adverse effects of the COVID-19 pandemic.

Claims on both life and non-life insurance lines increased in the last year. On the life side the raise in claims was brought on by the COVID-19 pandemic but also from life insurance contract reaching maturity. On the non-life side, catastrophe events in the US, Europe, and Asia Pacific lead to an increase in claims payments amounting to USD 185 billion, more than in 2018 or 2019.

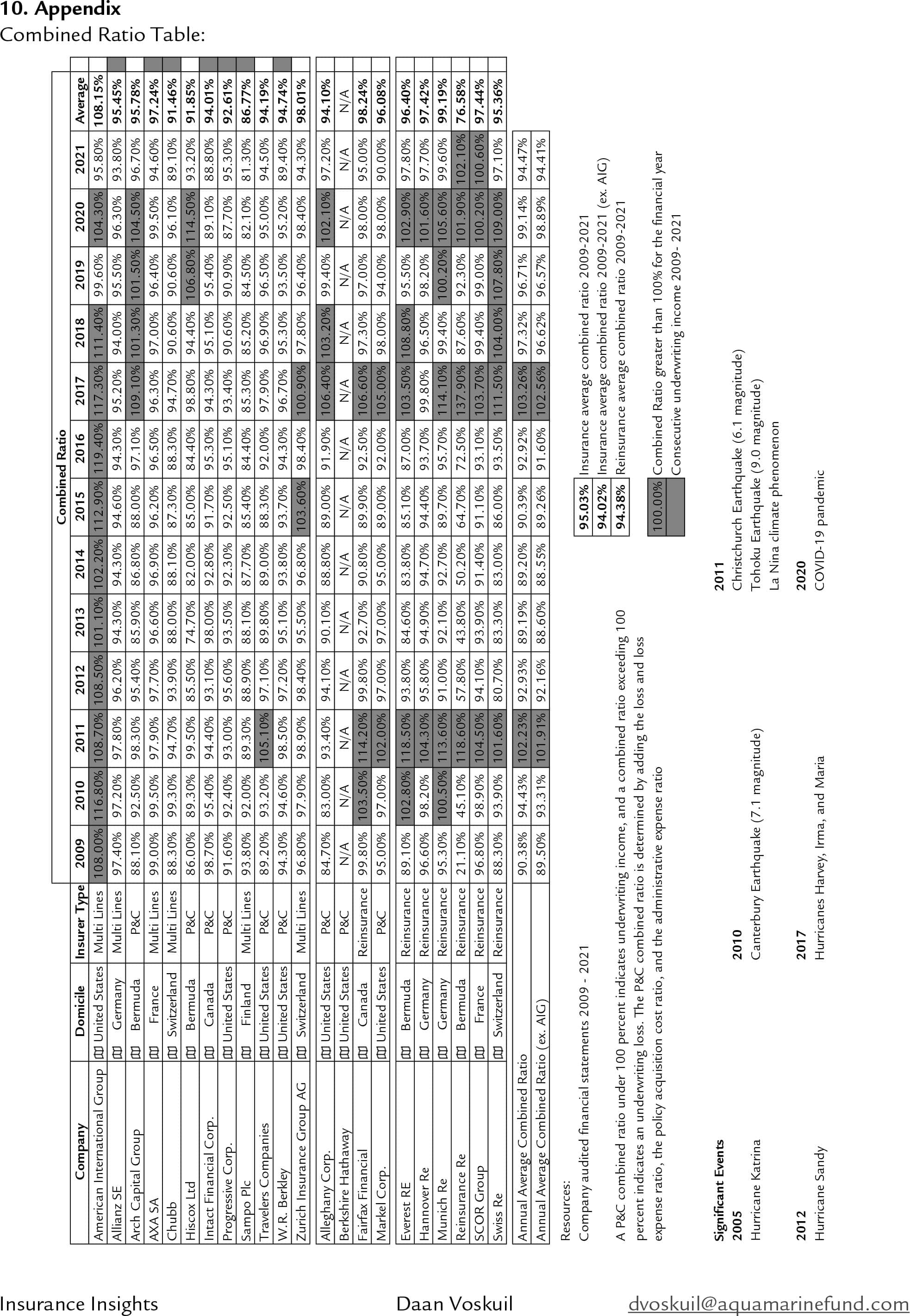

Profitability in insurance is highly dependent on the where and what risk is underwritten. The combined ratio is a measure of underwriting performance that represents the relationship of incurred losses and expenses to earned premiums. A combined ratio less than 100% is indicates an underwriting profit, while a figure over 100% indicates a loss%. Overall, the average combined ratio between 2014 and 2019 of the global P&C lines was around 97%. For health insurance lines, the combined ratio of was around 98%.

Inflation

Inflation rates are at multi-decade highs coupled with a global economic slowdown puts insurers in a precarious position in managing their underwriting portfolios. The inflationary effects from the high levels of fiscal stimulus injected into the economy in response to the COVID-19 pandemic and current supply chain disruptions and increased energy and commodity prices.

Slower economic growth usually leads to lower insurance demand. On the insurer side, inflation brings higher claims costs, especially for non-life and life insurance policies. Policies which benefits are defined at inception like motor, property, and casualty are most impacted in the short run. Rising claims costs can be attributed to supply disruptions and labor shortages. Insurers need to protect themselves from inflation, some business lines like motor or casualty have higher exposure than others.

Increasing interest rates will boost investment returns for insurers’ conservative, non-life portfolios.

Holders of insurance-linked securities will also experience an increase in claims costs. Risk interest spreads are also impacted by inflation as investors require higher nominal returns due to increased claims costs in order to maintain their real returns.

Insurance-Linked Securities

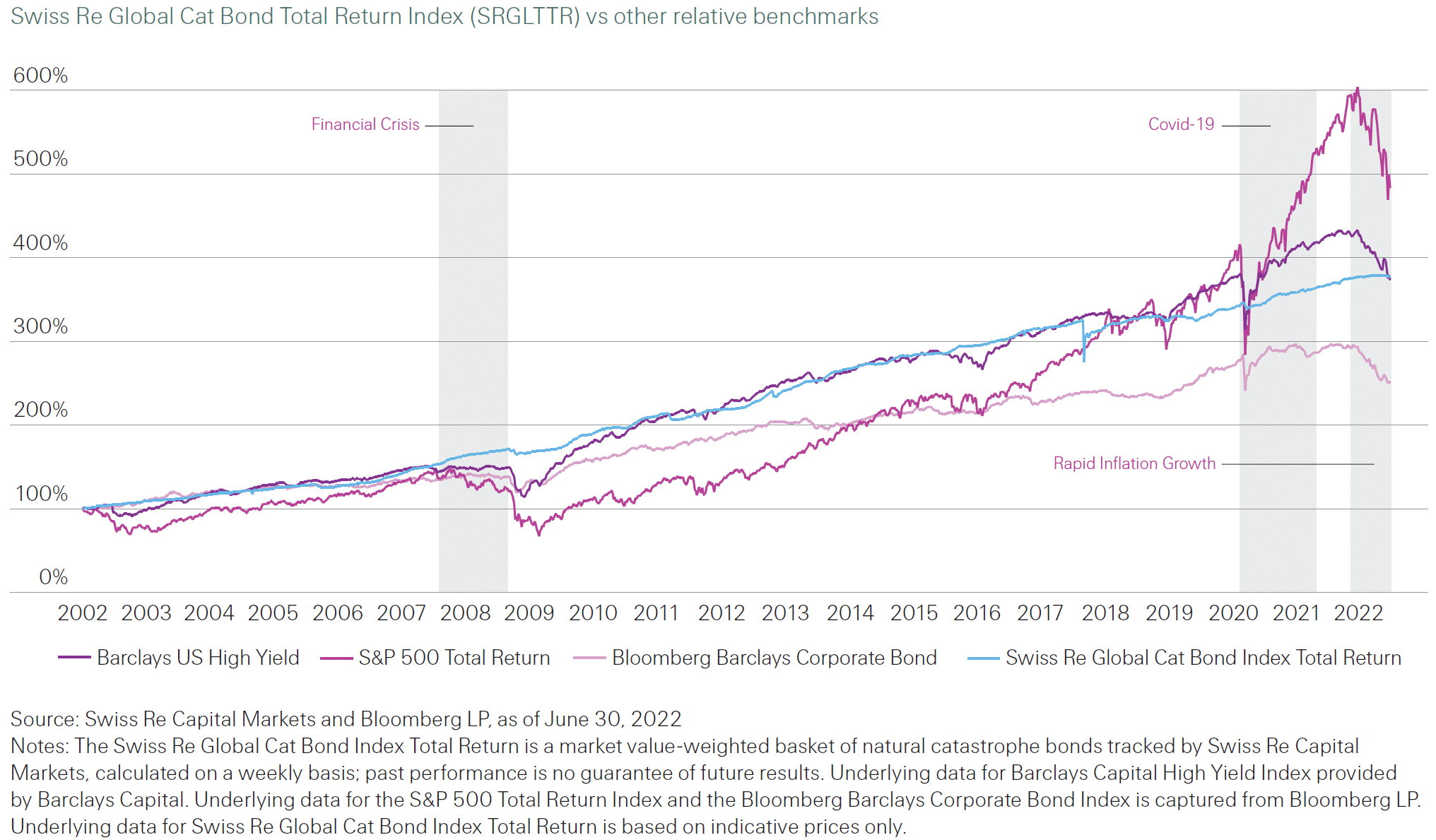

Insurers off-load risks they are not comfortable holding on their balance sheets through retrocession or turning to capital markets via insurance-linked securities. Accredited investors have the chance to purchase a high-yield diversified asset that has a low or negative correlation to the broader market in times of crisis. Securities can be structured in a variety of ways with the aim to minimize credit risk and provide adequate returns to investors.

The most common ILS is a catastrophe bond (cat bond), which is structured where the coupon and principal payments depend on the non-occurrence of a predefined catastrophic event, the performance of an insurance portfolio, or the value of a natural catastrophe risk index. The usual term for a cat bond is four years. If no trigger or event occurs during the period, the principal is returned.

Cat bonds can have various trigger mechanisms, these can be linked to indexes, parametric indicators, or models. The aim of the various triggers is to protect insurers’ proprietary information from competitors while maximizing deal transparency to investors.

Investor concerns do arise with ILS products. Adverse selection, where the insurer cedes the most problematic risks to investors who are then disproportionally exposed. Moral hazard worries investors because the ceded risk negatively changes the incentives of the insurer. Unsound underwriting practices by the insurer can expose both parties to increased risk.

5. Measuring Value Creation

Book Value Per Share

Growth in book value per share is the best measure of value creation for an insurer. Since 2009 for the better insurers roughly 70% of book value growth has come from underwriting profits and 30% from investment income. Prior to the 2008 financial crisis this was inverted. Today the industry has had four years of premium rate hardening and now companies can also enjoy much better investment returns.

Combined Ratio (P&C)

A P&C combined ratio under 100 percent indicates underwriting income, and a combined ratio exceeding 100 percent indicates an underwriting loss. The P&C combined ratio is determined by adding the loss and loss expense ratio, the policy acquisition cost ratio, and the administrative expense ratio.

6. Insurance Company Analysis

North American Insurers

Most North American-based insurers report in US GAAP, and Canadian insurers report use the IFRS framework. While IFRS reporting insurers can allow for large buffers to build, US GAAP reporting insurers cannot because of the accounting framework. US GAAP accounting principles do not allow for the holding of large reserves of reserves or the building of a significant buffer. US GAAP requires the reserves to be released when an insurance contract is terminated. This different framework leads US GAAP insurers to lower reserved compared to IFRS, especially German insurers. Because of this, the combined ratio is more volatile and quite difficult to control.

European Insurers

Most insurers in Europe report us IFRS. German insurers stand out because of the particular legal requirements demanded of them under German law. Allianz, Hannover Re, and Munich Re are required to use conservative best estimates when calculating reserves. These reserves are huge compared to their peers in other jurisdictions. While this can signal capital strength (and they do refer to this quite a lot in their annual reports, it also leads to an artificially better-combined ratio. Swiss insurers need to comply with SST (Swiss Solvency Test) which is similar to the Solvency II requirements for European-based insurers.

7. Comparing Insurers to Swiss Re

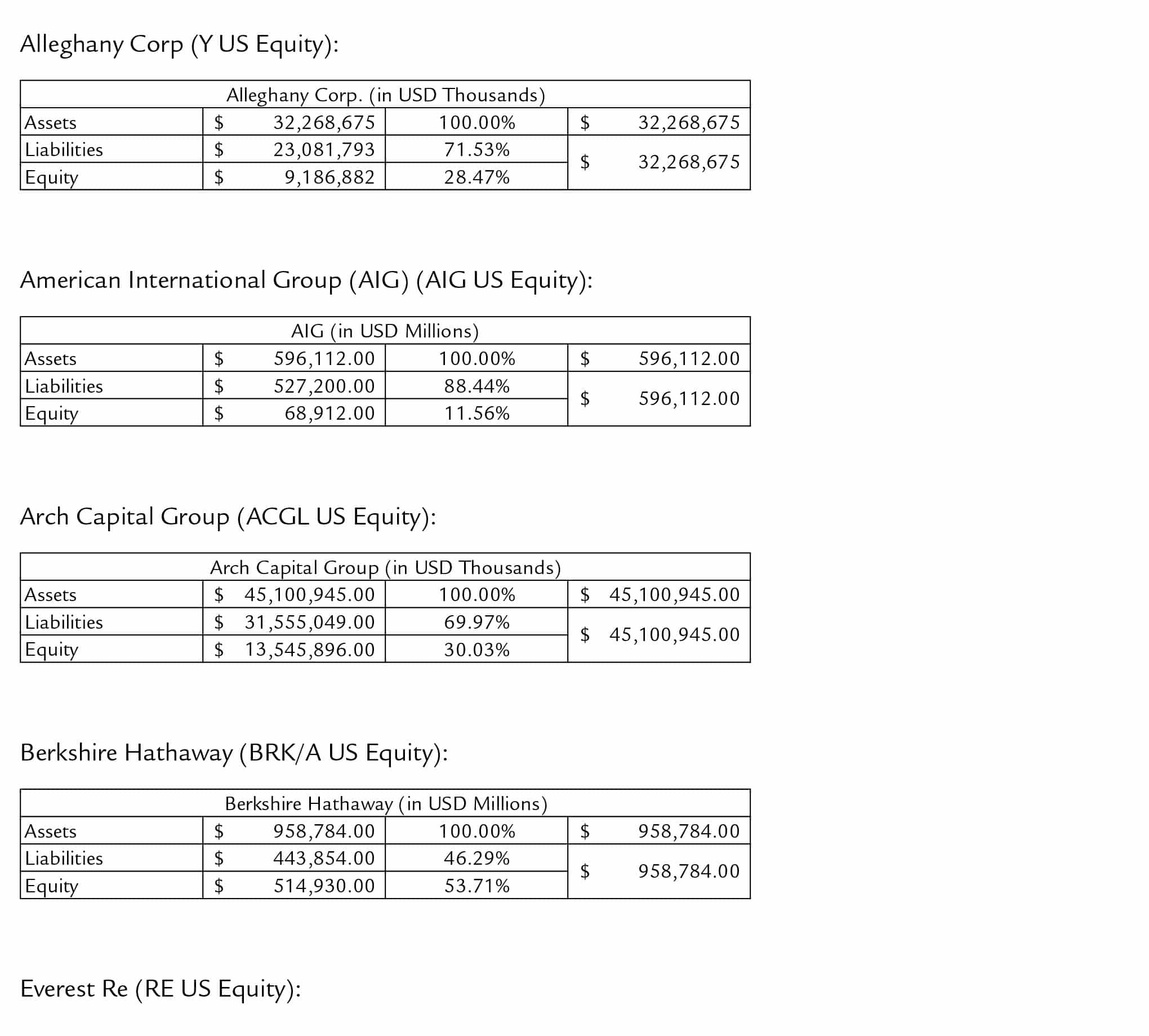

American International Group (AIG) (AIG US Equity):AIG is a leading global insurance underwriter focusing on general insurance (P&C and health), and Life and Retirement segment. The company primarily operates within North America, generating about 70% of its annual revenue there.

General insurance accounts for almost 60% of revenue for AIG and operates via three subsidiaries in North America (National Union, American Home, and Lexington) and three subsidiaries in the rest of the world (AIG Sonpo for Japan, AIG Asia Pacific, and AIG Europe). The Life and Retirement segment, primarily operating in the US, UK, and Ireland, makes up the about 40%. The Other Operations segment (less than 5% of revenue) offers corporate and institutional asset management services, including consolidation and elimination.

AIG distributes its products through many channels including specialty brokers, independent agents, financial advisors, banks, direct sales agents, and affinity groups. The company serves commercial, institutional (many Fortune 500 companies) and individual clients.

During the 2008 financial crisis, AIG made headlines with staggering losses and receiving USD 161.3 billion in bailout funds from the US government who in turn owned more than 90% of the insurer. By 2013 the US government had sold its last share in the company, during the restructuring process almost all non-insurance related operations were sold off.

AIG’s current strategy is “profitable growth”, “reinsurance optimization”, and “underwriting excellence.” Growth within the insurance industry is hard to come by organically, and inorganic growth is not a guarantee of profitability. Many primary insurers increasingly turn to reinsurers to off-load risk, large industry leaders like AIG, Allianz, and AXA can pass their insurance risk to their reinsurance branch AIG Re, Allianz Re, and AXA XL. This not only makes the risk sharing easier within the company but is also cheaper to do as no or fewer frictional costs need to be considered. Every insurance company in the world strives for underwriting excellence, anything short of this will guarantee costly losses for the business.

AIG Comparison with Swiss Re:

Swiss Re does a lot of reinsurance business with AIG, it is considered a Gloabls Client at Swiss Re which is a label given to only the 43 largest insurers in the world. Reinsurance business between the two firms will revolve around the risk transfer of standardized insurance products in the P&C and L&H segments. In the primary insurance market, Swiss Re Corporate Solutions competes with AIG to offer specialty insurance products to institutional clients.

Like AIG, Swiss Re generates most of its premiums in North America. The insurable market is not only larger than most other global regions but also more accessible for both customers and insurance companies (compared to China). Furthermore, wealth plays an important part in a region’s ability to insure its assets. Finally, Swiss Re offers investment and asset management services to corporate and institutional clients. Like at AIG, the revenue generated from this line of business is negligible when compared to the primary business segments.

Alleghany Corp (Y US Equity):

Alleghany Corporation is set up as a holding company, operating primarily in P&C reinsurance and insurance through its subsidiaries and investments. The company’s portfolio also contains non- financial market businesses which it owns and manages. The company was initially incorporated in 1929 by the Van Sweringen brothers to hold their railway holdings. Berkshire Hathaway has completed its USD 11.6 billion acquisition of Alleghany in October 2022.

The company offers reinsurance products in the US, UK, and Europe to its customers via TansRe, a New York City based reinsurance company which it acquired in 2012. Insurance products are offered via RSUI and CapSpeciality. RSUI is an Atlanta based wholesale specialty insurance underwriter which was acquired by the company in 2003 and focuses on P&C, professional liability, and management liability coverage. CapSpeciality is a specialty insurance underwriter focused on small businesses providing P&C, fidelity, surety, and professional lines coverage, it was acquired in 2002. Alleghany Capital owns and supports the diverse portfolio of non-financial businesses of the company. All three reinsurance and insurance companies generate about 70% of revenue for the Alleghany Corporation, with the remaining 30% generated by Alleghany Capital.

Most reinsurance products of TransRe are sold via brokers. Aon accounts for 30%, Marsh & McLennan for 25%, and TigerRisk for 10% of gross premiums written.

Alleghany Comparison to Swiss Re

Alleghany was created as a holding company to control a diverse range of businesses. Only in 1993 did Alleghany first enter the insurance industry by acquiring Underwriters Re, later selling it to Swiss Re in 1999, but maintaining ownership of the insurance business, Alleghany Underwriting Holdings Ltd. Swiss Re was created to provide reinsurance services as its core business, which it still does today. It has since expanded to other insurance business operations.

On the reinsurance and insurance side, Alleghany focuses on P&C underwriting which is has become increasing less profitable over the years because of climate change. However, by specializing on niche market segments within P&C, and some liability coverage, these losses may be minimized by selectively choosing which risks to underwrite.

Alleghany is similar to Berkshire Hathaway in how it uses its insurance float to invest non-financial operating companies through the Alleghany Capital subsidiary. Swiss Re, like many reinsurance companies, primarily invests its insurance premiums in high quality obligations as required by regulators and have little alternative options to generate returns otherwise.

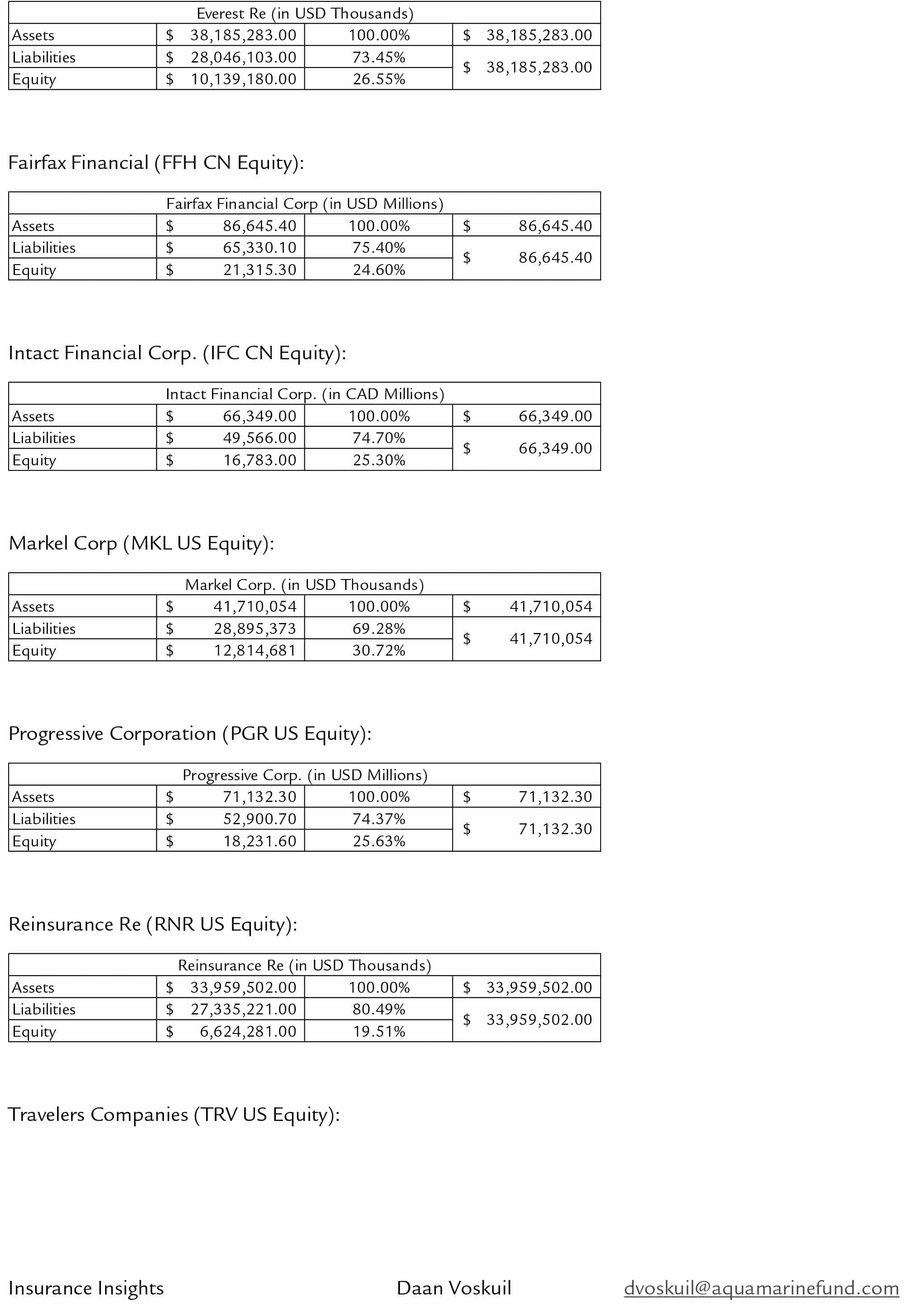

Markel Corp (MKL US Equity):Markel Corporation is a financial holding company operating in a variety of niche markets. Founded in 1930 as an insurance company for jitney buses, the company expanded to include reinsurance, and product and service businesses. The firm has three business units, Insurance which consists of specialty insurance underwriting and reinsurance, Investments which invests the premiums received from Insurance, and Markel Ventures which invests and manages in non-insurance companies.

Within the insurance business unit, insurance accounts for 85% of revenue and reinsurance for the remaining 15%. Insurance focuses on specialty products, which include hard-to-place risks written outside of standard markets and unique hard-to-place risks that must be written on an admitted basis due to regulatory requirements. The reinsurance business provides P&C and specialty treaty reinsurance such as political risk, mortgage, contract, and commercial surety to insurers globally. Markel is headquartered in Virginia but writes business through its international insurance division from offices in the North America, Europe, Asia, and the Middle East.

Insurance products are distributed through a network of independent agents and brokers. The top three independent brokers write 30% of the company’s gross premiums. Unlike standard insurers (whose rates are regulated), specialty insurers can charge rates they consider reasonable. This gives the insurance business freedom to price its products strategically.

Markel invests policy premiums, which come from sound underwriting practices, in high-quality government, municipal and corporate bonds that generally match the duration and currency of its loss reserve. Funds not invested in bonds are invested in equity securities through the Markel Ventures and Investments units. “The company seeks to invest in profitable companies, with honest and talented management, that exhibit reinvestment opportunities and capital discipline, at reasonable price.” Investments via Markel Ventures are intended to be held over the long term.

The Markel Corporation is like Berkshire Hathaway in the sense that it uses its insurance float to finance its equity investments in profitable companies with excellent management. The Co-Chief Executive Officer, Thomas Gayner, like Warren Buffet, oversees the investing activities of the firm with a reputable track record.

Markel Corp Comparison with Swiss Re:

Swiss Re and Markel’s insurance business compete on the primary and reinsurance level. Swiss Re’s Corporate Solutions also offers unique hard to place risk products. On the reinsurance side both companies offer specialized underwriting products for P&C risks.

While Swiss Re also invests in high-quality bonds that generally match the duration and of the contract’s loss reserve, Markel invests its float in the purchase of equity securities and sound businesses. This divergence in investment philosophy is guided by regulatory requirements but also by the make-up of the enterprise. Primary insurance generates more investable premiums than reinsurance, reinsured risks are generally regarded as riskier and thus would require a greater loss reserve.

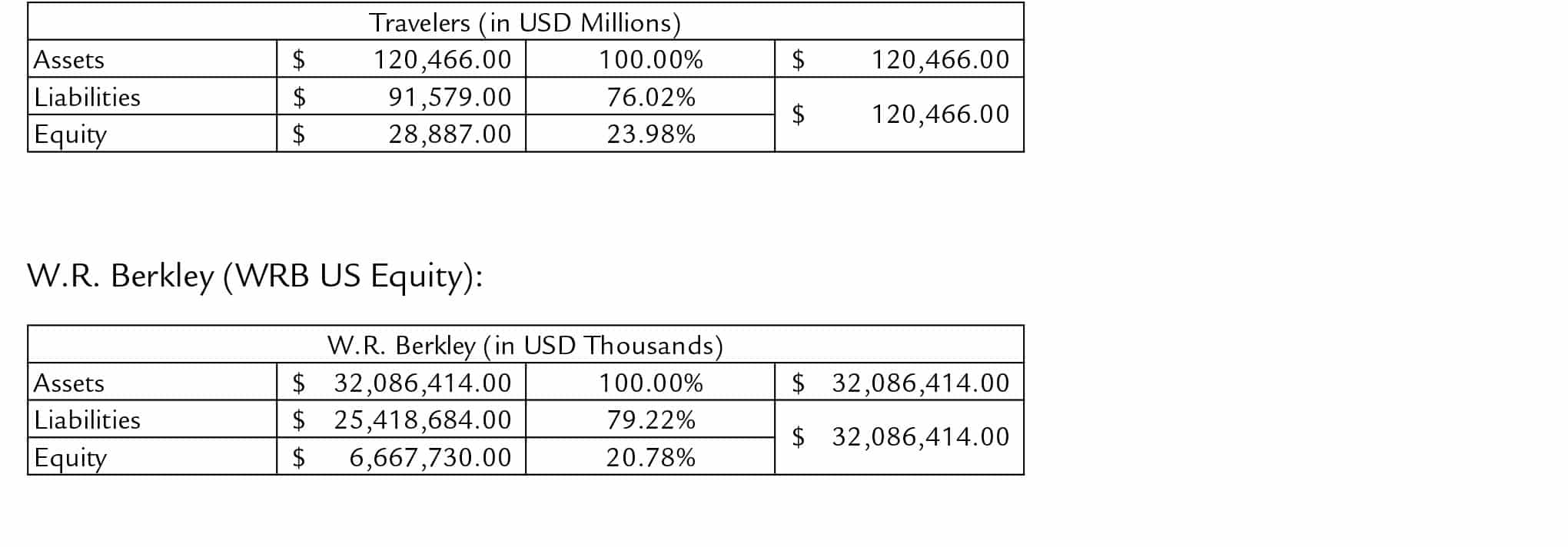

Swiss Re AG (SREN SW Equity):Founded in 1863, Swiss Re is the first reinsurance company founded in Switzerland following the 1861 fire of Glarus. Today the company offers reinsurance, insurance, and insurance linked financial market products, ranging from specialty property and casualty (P&C) insurance to life and health insurance (L&H). Swiss Re also offers products to the public sector, like parametric insurance contracts, via its Public Sector Solutions segment.

Swiss Re serves customers globally. Premiums generated in the Americas account for about 50%, EMEA about 30%, and Asia Pacific about 20%. The reinsurance business unit generates the largest amount of revenue, P&C accounting for 50% and L&H accounting for about 35%. The Corporate Solutions business unit offers specialty direct insurance products to large and mid-sized businesses and accounts for about 10% of total revenue. As of 2021, the iptiQ business unit, a digital B2B2C insurance company that provides customizable insurance products for customers (e.g. IKEA branded home insurance) and makes up the remaining 5%.

Swiss Re has been slowly transitioning its risk exposure in the reinsurance business unit from P&C to L&H due to the increased adverse effects of climate change across the globe. Reinsurance treaties are usually underwritten for a one-year period and renewed annually by Swiss Re with its insurance clients. This annual renewal allows for contracts to be renegotiated, underwriting larger or smaller amounts of risks, and changing terms and payout structures. Reinsurance contracts are underwritten either directly with the insurance client or via a broker. The two largest brokers used are Aon and Willis Tower Whatson.

Swiss Re manages USD 110 billion of assets according to the needs and objectives using an asset- liability management framework (matching insurance premiums with the anticipated payout scale of the lifetime of the insurance contract). The company takes pride in its financial strength and speed in which it can pay out re/insurance claims (usually within 5 days). The company’s internal solvency policy is to hold double the required capitalization as per the Swiss Solvency Test (SST).

The company markets itself as a risk knowledge entity, as one of the oldest global reinsurers it has the most data allowing it to create the most accurate risk models and thus charge the most accurate insurance premiums. Its strategy is to strengthen its key assets: global scale and presence, risk diversification, deep risk knowledge, and client collaboration.

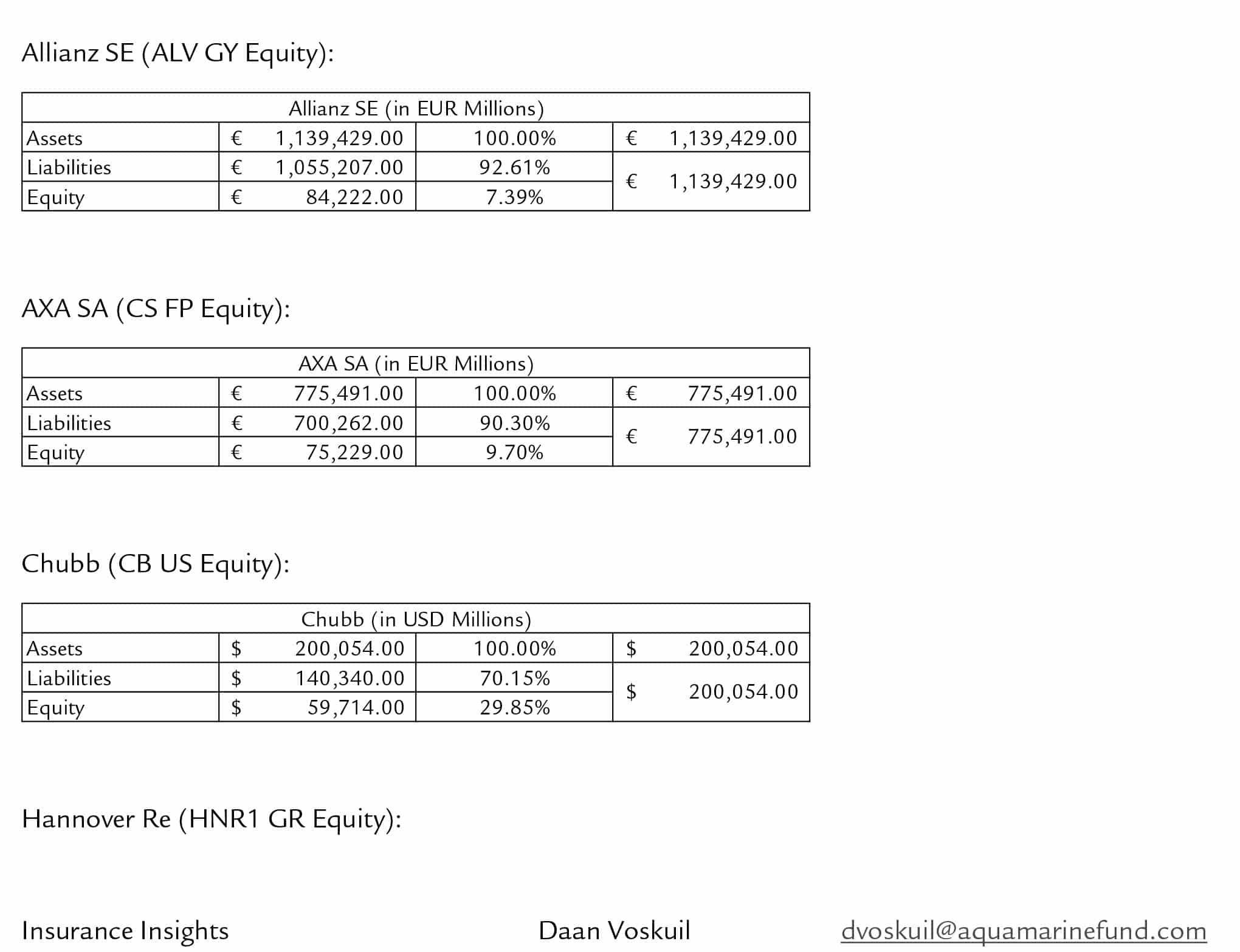

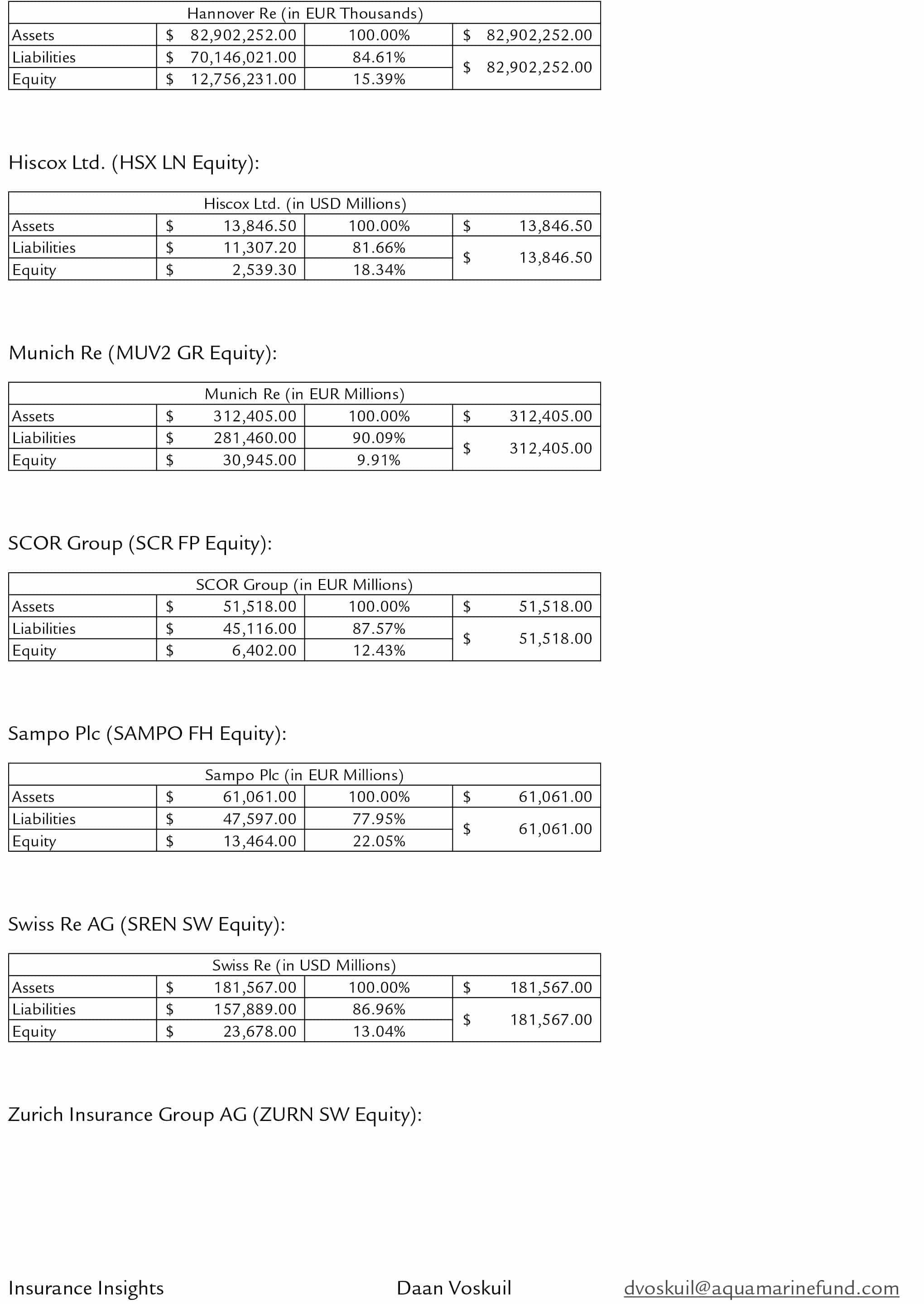

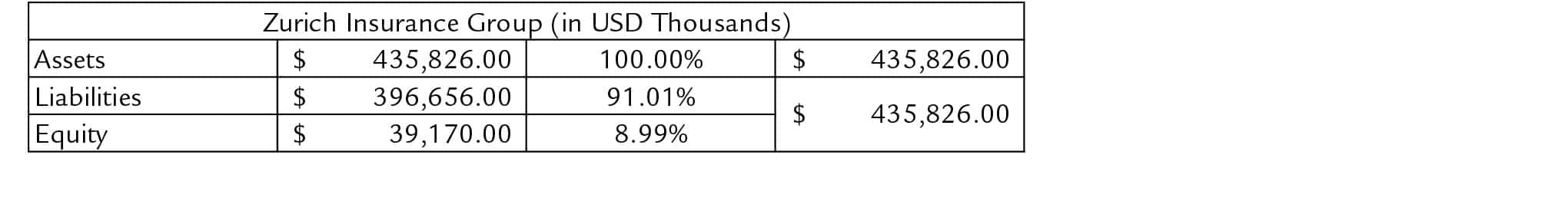

As of December 2021, Swiss Re’s balance sheet holds USD 181.5 billion US GAAP assets, USD 157.8 billion US GAAP liabilities, and USD 23.7 billion US GAAP shareholder’s equity. Swiss Re is currently the only European based insurer reporting in US GAAP. The company has announced its intention to adopt the IFRS 17 accounting framework as of January 1, 2024.

8. Accounting StandardsUS based insurance companies are required to prepare two different financial statements. The Statutory Accounting Principles (SAP) are a basis of accounting developed by state insurance regulators used to monitor and regulate solvency, it is primarily concerned with measuring the reinsurer’s or insurer’s surplus to policyholders. SAP determines the amount of statutory surplus and net income based on the value of assets and liabilities at the financial reporting dates. The US Generally Accepted Accounting Principles (US GAAP) is concerned with a company’s financial measures like income and cash flow, in addition to its solvency. US GAAP methodology considers the matching of revenues and expenses and management’s supervision of assets more heavily than SAP. Due to the difference in SAP and US GAAP methodology, the value of assets, liabilities and equity in prepared financial statements are materially different.

US based insurers provide non-GAAP financial measures based on their consolidated financial statements like underwriting profit and adjusted earnings before taxes to provide more useful and meaningful information to investors, analysts, rating agencies, etc. However, as these non-GAAP financial measures used by the industry are not standardized, the measures used by other companies may differ, thus limiting their usefulness for comparison purpose.

Effective January 1, 2023, International Financial Reporting Standards (IFRS) 17 – Insurance Contracts will come into effect. The new standard will introduce fundamental changes in the accounting treatment of insurance and reinsurance contracts, valuing them at current value using the “probability- weighted mean of the full range of possible outcomes.” The key objective for the International Accounting Standards Board (IASB) is to make IFRS insurance accounting consistent throughout the world improve comparability with other industries.

Simultaneously, the U.S. Financial Accounting Standards Board (FASB) will issue Accounting Standards Update (ASU) 2018-12 also known as Targeted Improvements for Long-Duration Contracts (LDTI). The ASU will amend existing requirements under US GAAP for certain insurance contracts. Key attribute of LTDI include annual updated assumptions for liability measurement, a standardized liability discount rate, greater consistency in fair value measurement of market risk benefits, simplified amortization and deferred acquisition costs, and enhanced disclosure requirements.

Although both announced accounting system changes strive to improve consistency between reporting standards, some fundamental differences remain leaving a gap between the current value framework of IFRS 17 and fair value framework of LDTI. For example, the IFRS 17 reserving approach follows a gross premium valuation wile LDTI follows a net premium valuation. Furthermore, on the financial impact of assumptions unlocking, IFRS 17 follows a prospective unlocking where future changes do not impact current period income while LTDI follows retrospective unlocking were future assumptions changes impact current period income.

9. Sources and Resources

Sources

Thank you to the following individuals for their industry insights and support:

-

- Emmanuel Clarke – Former CEO at Partner Re; Board member Intact Financial and Tremor

Technologies; Chairman of the Board Wakam and Compre Group

- Joe Taussig – CEO Taussig Capital

- Nick Martin – Polar Capital Global Insurance Fund Manager

- Jan Jaeger – Managing Director at Swiss Re

Resources

- Alleghany Corporation. (2022). Form 10-K. New York: Alleghany Corporation. Retrieved from

https://s24.q4cdn.com/857140222/files/doc_financials/2021/q4/251dbff6-c159-4341-ba3a-

8230d8ebada6.pdf - Allianz SE Reinsurance. (2022). About Us. Retrieved from Allianz:

https://www.allianzre.com/en_GB/about-us.html - American International Group, Inc. (2022, January 26). Reinsurance: Inside AIG Re and How it Engages wit

the World’s Insurance Industry. Retrieved from AIG

https://www.aig.com/about-us/newsroom/stories/inside-aig-re-and-how-it-engages-with-the-worlds-insurance-industry - AXA SA. (2022). AXA XL Reinsurance. Retrieved from Take Your Business Further:

https://axaxl.com/reinsurance - Deloitte Consulting LLP. (2019). Integrating Implementation for IFRS 17 and LDTI. Deloitte Consulting LLP.

Retrieved from

https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Financial-Services/gx-

Integrating-Implementation-for-IFRS17-and-LDTI.pdf - Financial Accounting Standards Board. (2018). Financial Services – Insurance (Topic 944) Targeted

Improvements to the Accounting for Long-Duration Contracts. Norwalk: Financial Accounting

Standards Board. Retrieved from https://fasb.org/Page/ShowPdf?path=ASU_2018-

12.pdf&title=ACCOUNTING+STANDARDS+UPDATE+2018-

12%E2%80%94FINANCIAL+SERVICES%E2%80%94INSURANCE+%28TOPIC+944%29%3A+TA

RGETED+IMPROVEMENTS+TO+THE+ACCOUNTING+FOR+LONG-

DURATION+CONTRACTS&acceptedDisclaimer=true&Submi - General Reinsurance AG. (2022). 2021 Annual Report General Reinsurance AG. Cologne: General

Reinsurance AG. Retrieved from

https://media.genre.com/documents/argrag21-en.pdf - Haynes, J. (1895, July). Risk as an Economic Factor. The Quarterly Journal of Economics, 9(4), 409-449.

Retrieved from https://www.jstor.org/stable/pdf/1886012.pdf - International Accounting Standards Board. (n.d.). IFRS.org. Retrieved from IFRS 17 Insurance Contracts:https://www.ifrs.org/issued-standards/list-of-standards/ifrs-17-insurance-

contracts/ - iptiQ. (2022). IKEA Powerd by iptiQ. Retrieved from HEMSÄKER Home Contents and Liability by IKEA:https://insurance.ikea.ch/quotation/welcome/en/HEMSAKER/insurance

- Kearney, L. W., Sevin, S. K., & Sofsky, W. (2020). How ASU 2018-12 Affects the Timing of Earnings Emergence The Potential Impact for the Insurance Industry. The CPA Journal. Retrieved fromhttps://www.cpajournal.com/2020/05/27/how-asu-2018-12-affects-the-timing-of-earnings-emergence/

- Markel Corporation. (2022). 2021 Markel Corporation Annual Report & Form 10-K. Glen Allen: Markel Corporation. Retrieved fromhttps://markel.gcs web.com/static-files/29681e1d-9cee-4b56-adcd-dad1df1cc2fe

- McKinsey & Company. (2021). Global Insurance Pools statistics and trends: An overview of life, P&C, and health

insurance. McKinsey & Company. Retrieved fromhttps://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insight

s/global%20insurance%20pools%20statistics%20and%20trends%20an%20overview%20of%20lif

e%20p%20and%20c%20and%20health%20insurance/global-insurance-pools-statistics-and-

tren - OECD. (2022). Global Insurance Market Trends 2021. Secretary-General of the OECD. Retrieved fromhttps://www.oecd.org/daf/fin/insurance/Global-Insurance-Market-Trends-2021.pdf

- PwC. (2021). 13.5 Key differences between SAP and US GAAP. PwC. Retrieved fromhttps://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/insurance-contracts/Insurance-

Contracts/Ch13_statutory_accounting/13_5keydifferencesbetween.html - Swiss Financial Market Supervisory Authority. (2022). Swiss Solvency Test (SST). Retrieved from finma:https://www.finma.ch/en/supervision/insurers/cross-sectoral-tools/swiss-solvency-test-sst/

- Swiss Re. (2011). The fundamentals of insurance-linked securities. Zurich: Swiss Re.

Swiss Re. (2015). The essential guide to reinsurance. Zurich: Swiss Re. Retrieved fromhttps://www.swissre.com/dam/jcr:d06472ab-2625-48cf-8b4e-7c7ac8aa63f0/The-essential-

guide-to-reinsurance.pdf - Swiss Re. (2022). Managing our assets. Retrieved from Swiss Re: https://www.swissre.com/our-

business/managing-our-assets.html - Swiss Re. (2022). sigma World insurance: inflation risks front and centre. Zurich: Swiss Re.

Swiss Re Institute. (2022). sigma explorer. Zurich, Zurich, Switzerland. Retrieved from https://sigma-explorer.com/index.html - Swiss Re Institute. (2022). sigma Natural catastrophes in 2021: the floogates are open. Zurich: Swiss Re

Management Ltd. Retrieved from https://www.swissre.com/dam/jcr:326182d5-d433-46b1-

af36-06f2aedd9d9a/swiss-re-institute-sigma-natcat-2022-en.pdf - Swiss Re Ltd. (2022). Financial Condition Report 2021. Zurich: Swiss Re Ltd. Retrieved from https://www.swissre.com/dam/jcr:4b75c4d8-8d5b-4202-89e9-05aa76c67c91/2021-swissre-

financial-condition-report.pdf