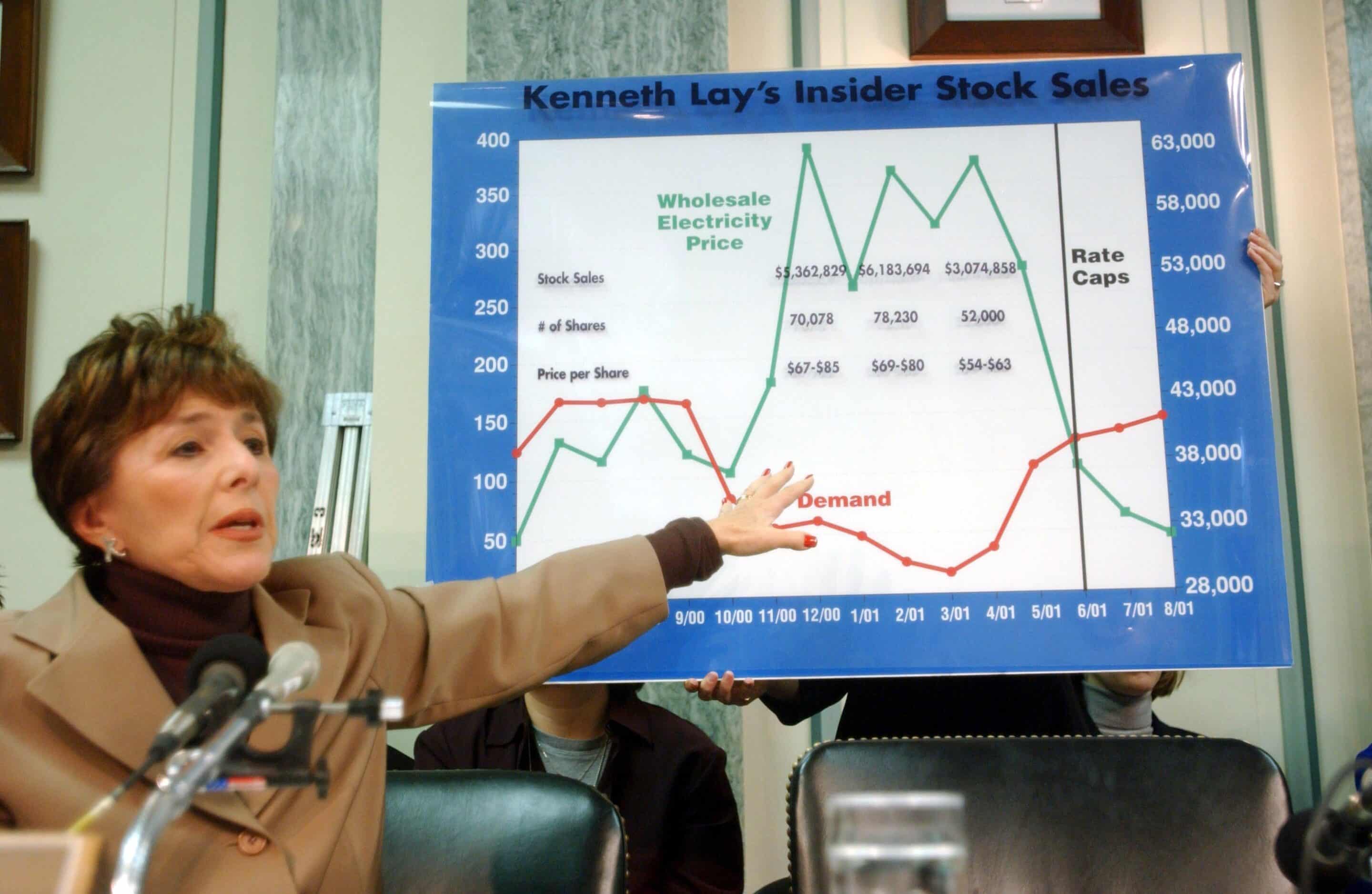

Photo by Ron Sachs/Shutterstock (376964c)

US Senator Barbara Boxer points out the huge disparity in energy demand (which was low) and energy prices – which spiked nastily) during the California energy crisis of the early 2000’s

In the early 2000s, the California energy market went into a crisis. Early in 2000, energy prices spiked. And then blackouts started. During a heatwave in the summer of 2000, 97,000 homes were blacked out. In 2001, following blackouts that affected hundreds of thousands, Governor Davis of California declared a state of emergency. By the end of the year, more than 1.5 million customers had been cut off from electricity, and Pacific Gas and Electric had filed for bankruptcy.

Source: Electricity Markets, Optimal Power Flow & LMG. Working Paper by Ryan Mann – Downloaded from Researchgate.

We can ask how it is possible that such a crisis could occur in a country as rich and developed as the United States. The cause was not a war in the Middle East, the machinations of some foreign player, or even an out-of-state player. The crisis was entirely the making of the state regulator. The California Public Utilities Commission – under the influence of Enron (now discredited and bankrupt) – had rewritten the rules to “deregulate the market”. Except that what it had actually done was to create an opportunity for traders like Enron to create artificial shortages and to spike electricity prices at key moments.

Could such a thing happen in India? I would have thought it unlikely. My experience of the Indian Administrative Service and the people who administer regulatory agencies – such as the Central Electricity Regulatory Commission of India (CERC) – is that they employ some of the most highly educated, intelligent, thoughtful, and farsighted people on the planet.

But India has recently seen some regulatory turmoil and it appears that some of the regulators are listening to the siren song of potential new players who, like Enron, are hoping to profit from a restructuring of the rules to benefit their business.

If India were to experience something like what happened in California, it would be extraordinarily damaging and would set India back enormously. So when the CERC called for public comment on possible regulatory changes for the Indian market, I was happy to furnish a submission, which you can find at the bottom of this post.

The basic thrust of the letter is that for more than two decades, Indian Energy Exchange has been delivering a reliable market in electricity to a broad and growing range of energy suppliers and distributors in India. During this period, an increasing proportion of India’s energy is being supplied by renewable but intermittent sources.

For India to fulfil its promise of parity with the West, the whole country needs to be furnished with sufficient electricity. As of today, India’s energy consumption is around 1/3 of developed economy levels and will require enormous amounts of investment capital.

A well-functioning electricity exchange is vital to ensure that capital continues to flow. Price discovery and deep markets are key factors in ensuring that suppliers can reliably hedge out their risks, while at the same time ensuring that energy users – the distribution companies and other industrial users – can plan their investments based on a reliable energy price.

So, it’s absolutely vital that the Indian Central Electricity Regulatory Commission continues to regulate the market in a prudent way. The name of the game is not to tinker or make drastic changes to what is already working very well.

Professor Niall Mac Dowell at the Sargent Centre for Process Systems Engineering at Imperial College also sent in a submission.

I am a proud investor in India Energy Exchange.

Why does California’s power grid keep flirting with disaster? We’ve got answers: LA Times